Just before noon yesterday, President Barack Obama proposed five new middle class benefits that will be detailed in his budget next Monday:

- Doubling the child care credit

- Funding child care for 235,000 additional children

- Supporting elder caregivers with counseling, training, transportation, and temporary respite care

- Ensuring Federal Student Loan payments won’t exceed 10% of income

- Establishing automatic IRA’s and expanding the saver’s credit for working families

I am very concerned about the strength of our economic recovery during the second half of this year, but these tax cut won’t have much impact on the recovery until at least a year from now if Congress passed them this spring.

We won’t see official cost estimates until Monday morning, but these will undoubtedly add significantly to the deficit.

Targeting children and students through established programs makes sense to the extent that these children grow up to be more productive taxpayers. Too many elderly worked for employers without retirement plans or earned too little to set aside much for retirement, so I wouldn’t object to a well designed program there either.

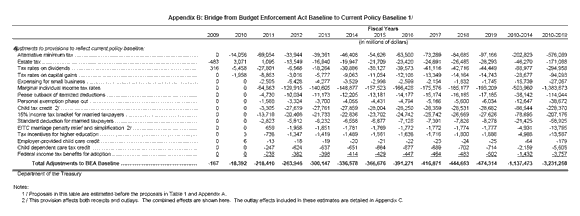

However, you have to ask yourself, when do the tax cuts stop? What about the Bush tax cuts? Last May, President Obama proposed extending most of them, except for those with incomes over $250,000, and recently his White House leaked the possibility that he might propose extending all of them. That would cost approximately $3 trillion over the next 10 years according to Treasury’s Green Book. See Appendix Table B. The previous table shows that removing the Bush tax cuts for those over $250,000 would only save about 20% of that. Somebody is going to have to pay the taxes to restore fiscal balance in the face of the first ever trillion dollar deficits. Scott Hodge of the Tax Foundation shows that about one-third of individual income tax filers report zero or negative liability. Ten years ago it was only one-quarter and forty years ago it was one-fifth.

(click to enlarge)

It will be interesting to see how much deficit reduction President Obama proposes.

Table: Treas.gov

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply