An interim bulletin EWT today reiterates the 200% short position. I hadn’t commented on it, but that position was pulled in an interim bulletin a few days ago, but today everything is now working out as the January 4 EWT predicted: Dollar up, Gold down, and stocks down. He says go back short. Neely also called the top in a special bulletin today.

For you technical analysts, the drop today is deep enough to end the prior wave and start something new. The S&P got to 1115 and bounced, slightly; that is a key level to watch today. If it breaks, likely we have a “bifurcation” off the top and a much longer and deeper drop ahead.

For you skeptical fundamentalists, note how tectonic plates are shifting globally:

- ECB likely to have to bail out Greece, and the Euro has dropped below a double-cross of moving averages, pointing to a fall to $1.38

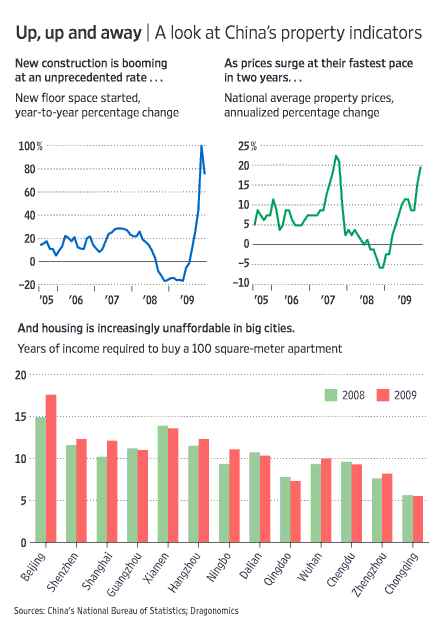

- China’s vaunted stimulus (pundits said “China sure knows how to stimulate better than the US!”) has caused a huge real estate bubble, with ghost cities, empty buildings, and skyrocketing home prices in major cities – oops! China is the new Japan – Japan 1989

- Dollar is taking off, probably now into wave 3 off the bottom, heading from 78 to over 90 in the Dollar Index

- Earnings reports have been disappointing, even good ones – and when a market sells off a decent report, the Bear has returned

- Unemployment had a weekly spike, throwing cold water on the recovery

- Democrats in disarray as the “Scott heard around the World” seems to put the stake into Obamunism

Simply put, the assumptions that drove 2009 up are now up in the air, and the market needs to digest the fallout. Meanwhile outside the US the chickens are beginning to come home to roost.

In 1930 we had an apparent recovery from the crash, and then slowly developing problems; but in 1931 the crisis came back in the form of banking failures in Europe, and overwhelmed the US economy. Is history repeating, this time with China as part of the potential brewing crisis? This chart from today’s WSJ shows how the Chinese Stimulus has not gone into real production but into hoarding and speculation, just as in the US:

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply