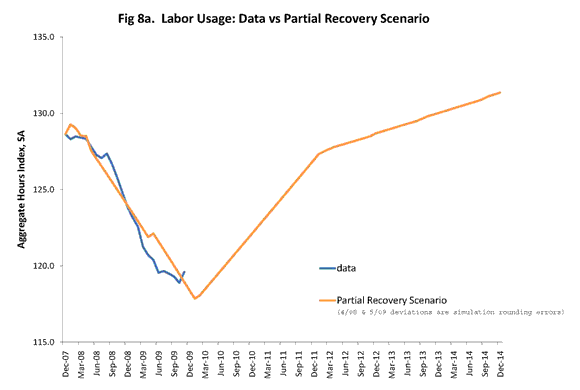

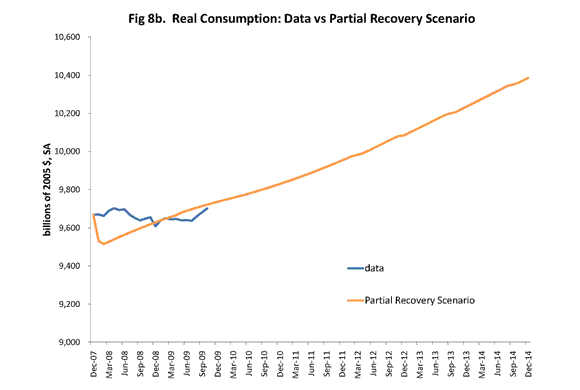

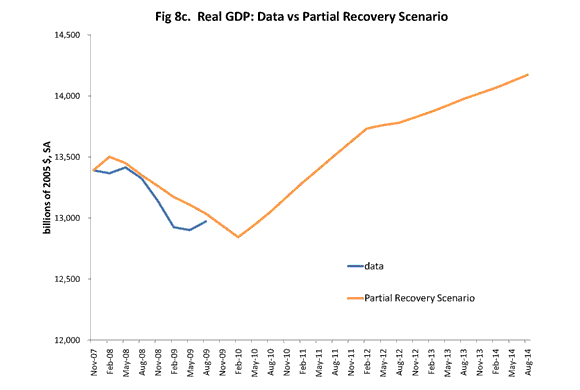

The aggregate neoclassical growth model – with a labor income tax or “labor market distortion” that began growing at the end of 2007 as its only impulse – produces time series for aggregate labor usage, consumption, investment, and real GDP that closely resemble actual U.S. time series. Of particular interest is the fact that the model – with no explicit financial market – has investment fall steeply during the recession not because of any distortions with the supply of capital, but merely because labor is falling and labor is complementary with capital in the production function. Through the lens of the model, the fact the real consumption fell significantly below trend during 2008 suggests that labor usage per capita could get somewhat lower than it was at the end of 2009, and is expected to remain below pre-recession levels even after the “recovery.”

Previously I have posted these forecasts as deviations from trend. Here are some forecasts in levels.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply