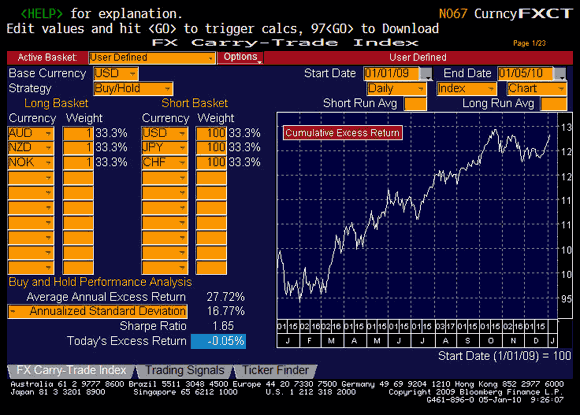

2. G10 FX carry will NOT repeat 2009’s stellar performance.

The simple “up three, down three” FX carry basket (wherein you go long the three highest yielders in the G10 and go short the three lowest yielders) rallied nearly 28% last year, exceeding the returns on the SPX and retracing virtually all of 2008’s losses. This was partially a function of similar drivers to those cited above for the oil rally (particularly the delta of economic expectation), but also of dollar weakness, courtesy of QE and the Fed’s promise to not rock the boat in ’09. Now, we’re left with a situation where the delta of expectation and of monetary policy are more uncertain, and some of the high-yielders look pretty expensive (we’re lookin’ at you, NZD.) While a passive carry basket may well generate a positive P/L in 2010, returns pushing 30% and a 1.65 ain’t gonna happen.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!