There is talk in the air of a second stimulus. Actually, it would be the third since Bush passed one before he left us. Thanks, W, and good riddance!

There is talk in the air of a second stimulus. Actually, it would be the third since Bush passed one before he left us. Thanks, W, and good riddance!

Comments to my post on Embracing the W show some continued confusion over the timing of the Stimulus, so let me update everyone.

The specific stimulus bill counted out at $787B. I suppose you could include the unspent TARP as well, and the earmarks that got TARP passed ($180B?). Plus we had a $300B real estate bailout passed under W during the election summer of 2008. So we are at well north of $1T of stimulii.

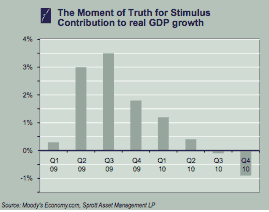

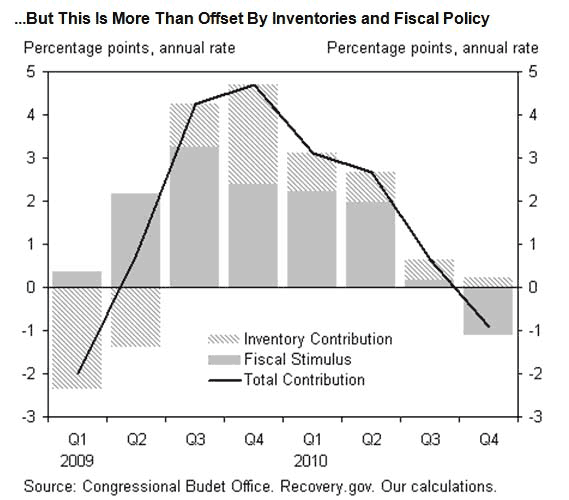

For a good resource, download PeakStimulus. This first chart is from that report. The second chart is from Goldman Sachs and includes inventory rebuilding. They both show that the peak of stimulus is right now.

You can also read my take on this from prior posts, here and here. My preliminary conclusion in late August was that gimmicks – what I call Cash4GDP – have had a bigger impact than the stimulus itself. At least, easier to measure.

This isn’t to say that the Stimulus isn’t helping to buoy up GDP. It is. But the peak impact is now. It is downhill from here. A year from now, 70% of it will have been spent, and the remainder will be so stretched as to be lost in the noise. We actual risk the remainder having a negative impact, particularly if we try to reduce the short term deficit.

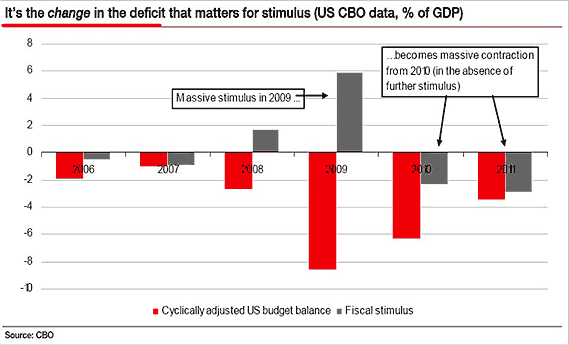

This may sound paradoxical, but take a look at the third chart. Since we have already be running high government spending (for years), the change in spending is what has a stimulative impact. If we reduce spending, as is inevitable without a second third stimulus, it has a negative effect, at least to the extent that government spending has much effect at all.

This isn’t to cheerlead for a new stimulus. Quite the opposite. The way out of our mess is to fix the financial sector and get the private economy on its feet. The many stimulii simply kick the can forward of that fix and put the economy on life support. Necessary adjustments are postponed. We are turning Japanese, indeed!

The silver lining in this leaden approach to our golden economy is that these stimulii don’t do much, so the negative impact may not be that impactful, just as the third stimulus won’t do much in the short run. In the long run the excessive debt, malinvestment and waste from the stimulii eat into our national wealth and impoverish us. Also, the long run may not be that far out.

Now, as to the Stimulus itself.

A big chunk of it (35%) has been tax credits to lower income (or no income) people, and that is being paid out weekly as we speak. Ford did that in 1975, to no effect. His failure got studied and it was realized that temporary changes to income are squirreled away in quick savings (not investments) or used to pay down debt. As such they act as a black hole in terms of stimulus. Bush did it twice, the second time in 2008. No impact. Christina Romer of Obama’s Council of Economic Advisors studied these rebates and concluded a permanent tax cut has a 3x stimulus effect whereas these one-time rebates are inconsequential at best if not politically expedient and economically wasteful. (So why were they put into the Porkulus? Maybe because Obama cared more at that time about “social justice.” meaning redistribution of wealth, than fixing the economy. Now his mistake is becoming apparent, even to him inside his bubble.)

Of the rest about $100B or 12% is well-designed to have an impact (according to the WSJ). The leftover balance is obscure in its impact. For example, a chunk goes to K12. I have a company selling into K12 and have visibility into how some of the stimulus money is being handled. Confusion reigns, and almost no jobs have been created. Why? No school district wants to hire with a one-time stimulus, and then fire when the government life support goes away. Instead they are trying to figure out what to do with it. In this way a chunk of the obscure part of the stimulus may be out of the Feds and into the school districts where is is hung up in a type of indecision purgatory.

Around $200B is considered direct aid, much of it to State governments or State construction projects. How is that being spent? There is a brewing scandal in California because the state unions are plundering the budget. More jobs? No, saved featherbedding jobs, more benefits and retroactive pay increases! An Orange Count firefighter makes $175K. Yes, you heard that right. Shocking, to say the least. Maybe they are using the vig they are collecting to buy cash4clunker cars, who knows.

In any event the schedule of flows of these funds peaked in Q3. To the extent it is still hung up in the hands of some “czar”, or has left the Feds and gone into “indecision purgatory” before it is actually spent, the peak spending is in Q4 with slop-over into Q1. Right now. This is as good as it gets.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

We will have to deal with the deficit and the money printing one way or an other. There is just no way around it. The longer we wait the harder it will get. Although I think the Democrats will do what ever they can to pass a stimulus so they won’t get trashed in the 2010 elections. However that might actually back fire with the dollar declining even more then it already has and causing oil to go over 100 USD. The government will have to borrow 3 trillion next year so if you add an other stimulus on top of that it will be 4 trillion. That is close to a 100 billion a week. How long do you think it will take before the only buyers will be the US Banks who actually get their money from the FED.

The end of this whole mess is very close. We all better be prepared.