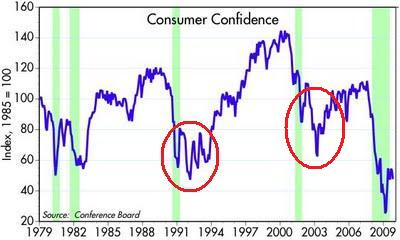

Scott Grannis: I’ve never paid much attention to surveys of confidence, mainly because they tend to be lagging indicators. As these charts show (one appears above), consumers are often quite happy until just before a recession starts, and quite depressed well after a recovery begins.

Brian Wesbury and Bob Stein: Meanwhile, the Conference Board’s measure of consumer confidence fell to 47.7 in October from 53.4 in September, as consumers’ assessment of the present situation dropped to the lowest level since 1983. It is not unusual for this measure to bottom after a recession is over and we are more pleased by evidence of actual spending increases than we are dismayed by consumers claiming discontent.

Exhibit A: “Whining” hardly captures the extent of the gloom Americans feel about the current downturn. The slump is the longest, if not the deepest, since the Great Depression. Traumatized by layoffs that have cost millions of jobs during the slump, U.S. consumers have fallen into their deepest funk in years.

“Never in my adult life have I heard more deep-seated feelings of concern,” says Howard Allen, retired chairman of Southern California Edison. “Many, many business leaders share this lack of confidence and recognize that we are in real economic trouble.”

Says University of Michigan economist Paul McCracken: “This is more than just a recession in the conventional sense. What has happened has put the fear of God into people.”

Exhibit B: If America’s economic landscape seems suddenly alien and hostile to many citizens, there is good reason: they have never seen anything like it. Nothing in memory has prepared consumers for such turbulent, epochal change, the sort of upheaval that happens once in 50 years. That may explain why so many polls reveal such ragged emotional edges, so much fear and misgiving. Even the economists do not have a name for the present condition, though one has described it as “suspended animation” and “never-never land.”

Both excerpts above are from Time Magazine (altered slightly) articles written AFTER the July 1990 – March 1991 recession had ended, the first was from January 13, 1992 (ten months after the recession) and the second from September 28, 1992 (21 months following the recession). As the circled area on Scott’s chart above indicates, consumer confidence remained low for two years following the end of the 1990-1991 recession and it took about three years for consumer confidence to rise to the pre-recession level. The circled pattern following the 2001 recession was similar.

Bottom Line: Even though there is general consensus that the recession ended this summer (probably in June), consumer confidence will likely remain choppy and low through next year, and we’ll get reports like these Time Magazine articles about how bad everything is for at least another year as well.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply