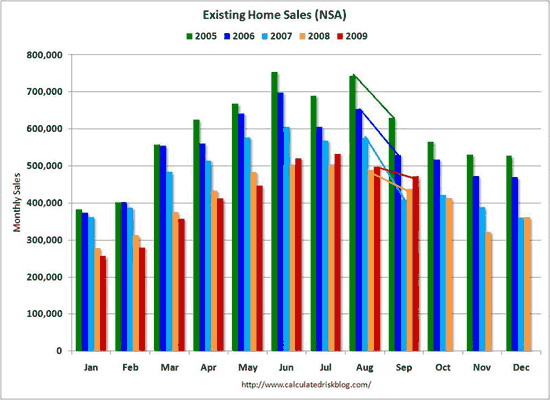

The Natl Association of Realtors gushes Big Rebound in Existing-Home Sales Shows First-Time Buyer Momentum. In fact, sales DROPPED in September despite the rush to cash in on Clash4McMansions (the home buyer credit that expires shortly). Chart from Calculated Risk, as modified by The Big Picture. Barry Ritholtz says this of NAR:

I am honestly unsure of whether the folks at the NAR are dumb as lawn furniture and make these misrepresentations honestly — or whether are just another group of disgusting spin doctors, willfully peddling lies because it helps their own agenda.

The NAR report relies on seasonally-adjusted data. Actual sales dropped 5% from the prior month. This is less than the normal drop from August to Sept, hence the gushy headline, but then again normally there aren’t Cash4Gimmicks incentives skewing things. Distressed sales also made up 29% of the results. In a followup at Calculated Risk, Existing Home Sales: More Activity, Little Achievement, the distressed sales are distorting the results but are a necessary step forward – getting rid of the past overhang. As I noted in a recent post, however, that overhang is increasing pretty fast for Prime loans even as we work through the subprime disaster from the last few years.

Mark Hanson does a pretty devastating analysis of the gimmickry. When the first-time buyer incentive expires in a month, the same sort of drop-off we are seeing in auto sales after Cash4Clunkers should shock & awe.

Rather than declare premature victory and rely on short-term gimmicks, we need to let the market work through the overhang. Only after that can housing return to normal. Sadly, pushing gimmicks to incent new purchases by people of marginal credit only sets in motion a new overhang when they get into trouble.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply