There are few events that catch markets by complete surprise but the decision by British voters to leave the EU comes close. As markets struggle to adjust to the aftermath, analysts and experts are looking backward, likening the event to past crises and modeling their responses accordingly. There are some who see the seeds of a market meltdown, and believe that it is time to cash out of the market. There are others who argue that not only will markets bounce back but that it is a buying opportunity. Not finding much clarity in these arguments and suspicious of bias on both sides, I decided to open up my crisis survival kit, last in use in August 2015, in the midst of another market meltdown.

The Pricing Effect

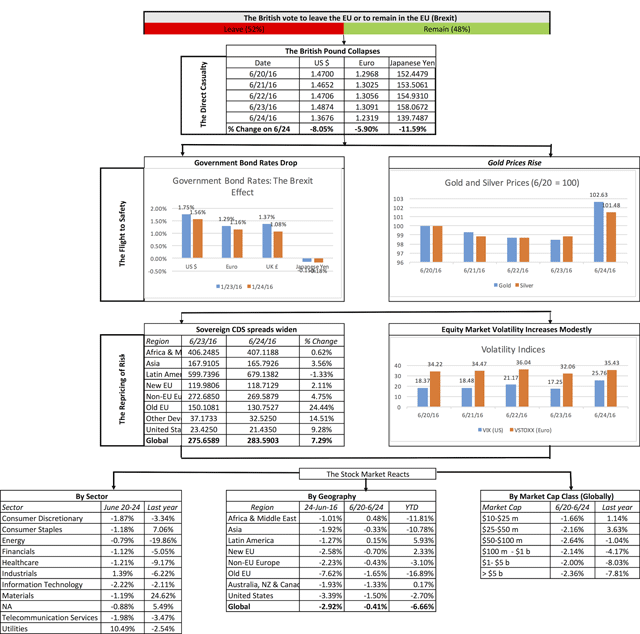

I am sure that you have been bombarded with news stories about how the market has reacted to the Brexit vote and I won’t bore you with the gory details. Suffice to say that, for the most part, it has followed the crisis rule book: Government bond rates in developed market currencies (the US, Germany, Japan and even the UK) have dropped, gold prices have risen, the price of risk has increased and equity markets have declined. The picture below captures the fallout of the vote:

While most of the reactions are not surprising, there are some interesting aspects worth emphasizing.

- Currency Wars: If this is a battle, the British Pound is on the front lines and taking heavy fire, down close to 10% over the last week against the US dollar and approaching three-decade lows, with the Euro seeing collateral damage against the US dollar and the Japanese Yen.

- Old EU, New EU and the Rest of the World : The damage is greatest in the EU, but even within the EU, it is the old EU countries (primarily West European, that joined the EU prior to 2000) that have borne the biggest pain, with sovereign CDS spreads rising and stock prices falling the most. The new EU countries (mostly East European) have been hurt less than Britain’s other trading partners (US, Australia and Canada) and the damage has been muted in emerging markets. At least for the moment, this is more a European crisis first than a global one.

- Banking Problems? Though I have seen news stories suggesting that financial service companies are being hurt more than the rest of the market by Brexit and that smaller companies are feeling the pain more than larger ones, the evidence is not there for either proposition at the global level. At more localized levels, it is entirely possible that it does exist, especially in the UK, where the big banks (RBS, Barclays) have dropped by 30% or more and mid-cap stocks have done far worse than their large-cap counterparts.

While I did stop the assessment as of Friday (6/24), the first two days of this trading week have continued to be volatile, with a big down day on Monday (6/27) followed by an up day on Tuesday (6/28), with more surprises to come over the next few days.

The Value Effect

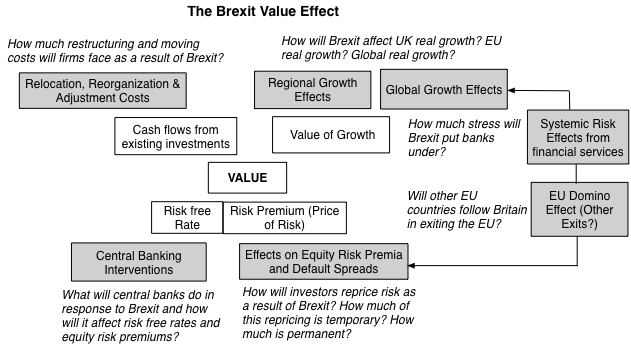

As markets make their moves, the advice that is being offered is contradictory. At one end of the spectrum, some are suggesting that Brexit could trigger a financial crisis similar to 2008, pulling markets further down and the global economy into a recession, and that investors should therefore reduce or eliminate their equity exposures and batten down the hatches. At the other end are those who feel that this is much ado about nothing, that Brexit will not happen or that the UK will renegotiate new terms to live with the EU and that investors should view the market drops as buying opportunities. Given how badly expert advice served us during the run-up to Brexit, I am loath to trust either side and decided to go back to basics to understand how the value of stocks could be affected by the event and perhaps pass judgment on whether the pricing effect is under or overstated. The value of stocks collectively can be written as a function of three key inputs: the cash flows from existing investment, the expected growth in earnings and cash flows and the required return on stocks (composed of a risk free rate and a price for risk). The following figure looks at the possible ways in which Brexit can affect value:

Embedded in this picture are the most extreme arguments. Those who believe that Brexit is Lehman-like are arguing that it will lead to systemic shocks that will lower global growth (not just growth in the UK and the EU) and increase the price of risk. In this story, these shocks will come from banking problems spilling over into the rest of the economy or an unraveling of the EU. Those who believe that Brexit’s effects are more benign are making a case that while it may reduce UK or even EU growth in the short term, the effects of global growth are likely to be small and/or not persistent and that the risk effect will dissipate once investors feel more reassured.

I see the truth as falling somewhere in the middle. I think that doomsayers who see this as another Lehman have to provide more tangible evidence of systemic risks that come from Brexit. At least at the moment, while UK banks are being hard hit, there is little evidence of the capital crises and market breakdowns that characterized 2008. It is true that Brexit may open the door to the unraveling of the EU, a bad sign given the size of that market but buffered by the fact that growth has been non-existent in the EU for much of the last six years. If the European experiment hits a wall, it accelerate the shift towards Asia that is already occurring in the global economy. I also think that those who believe that is just another tempest in a teapot are too sanguine. The UK may be only the fifth largest economy in the world but it has a punch that exceeds its weight because London is one of the world’s financial centers. I think that this crisis has potential to slow an already anemic global economy further. If that slowdown happens, the central banks of the world, which already have pushed interest rates to zero and below in many currencies will run out of ammunition. Consequently, I see an extended period of political and economic confusion that will affect global growth and some banks, primarily in the UK and the US, will find their capital stretched by the crisis and their stock prices will react accordingly.

The Bigger Lessons

It is easy to get caught up in the crisis of the moment but there are general lessons that I draw from Brexit that I hope to use in molding my investment strategies.

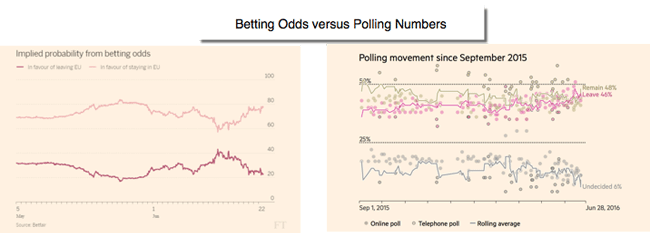

Markets are not just counting machines: One of the oft-touted statements about markets is that they are counting machines, prone to mistakes but not to bias. If nothing else, the way markets behaved in the lead-up to Brexit is evidence that markets collectively can suffer from many of the biases that individual investors are exposed to. For most of the last few months, the British Pound operated as a quasi bet on Brexit, rising as optimism that Remain would prevail rose and falling as the Leave campaign looked like it was succeeding. There was a more direct bet that you would make on Brexit in a gamblers’ market, where odds were constantly updated and probabilities could be computed from these odds. Since Brexit was also one of the most highly polled referendums in history, you would expect the gambling to be closely tied to the polling numbers, right? The graph below illustrates the divide.

While the odds in the Betfair did move with the polls, the odds of the Leave camp winning never exceeded 40% in the betting market, even as the Leave camp acquired a small lead in the weeks leading up to the vote. In fact, the betting odds were so sticky that they did not shift to the Leave side until almost a third of the votes had been counted. So, why were markets so consistently wrong on this vote? One reason, as this story notes, is that the big bets in these markets were being made by London-based investors tilting the odds in favor of Remain. It is possible that these investors so wanted the Remain vote to win and so separated from this with a different point of view that they were guilty of confirmation bias (looking for pieces of data or opinion that backed their view). In short, Brexit reminds us that markets are weighted, biased counting machines, where if big investors with biases can cause prices to deviate from fair value for extended periods, a lesson perhaps that we learned from value investors piling into Valeant Pharmaceuticals.

No one listens to the experts (and deservedly so): I have never seen an event where the experts were all so collectively wrong in their predictions and so completely ignored by the public. Economists, policy experts and central banks all inveighed against exiting the EU, arguing that is would be catastrophic, and their warnings fell on deaf years as voters tuned them out. As someone who cringes when called a valuation expert, and finds some of them to be insufferably pompous, I can see why experts have lost their cache. First, in almost every field including economics and finance, expertise has become narrower and more specialized than ever before, leading to prognosticators who are incapable of seeing the big picture. Second, while economic experts have always had a mixed track record on forecasting, their mistakes now are not only more visible but also more public than ever before. Third, the mistakes experts make have become bigger and more common as we have globalized, partly because the interconnections between economies means there are far more uncontrollable variables than in the past. Drawing a parallel to the investment world, even as experts get more forums to be public, their prognostications, predictions and recommendations are getting far less respect than they used to, and deservedly so.

Narrative beats numbers: One of the themes for this blog for the last few years has been the importance of stories in a world where numbers have become more plentiful. In the Brexit debate, it seemed to me that the Leave side had the more compelling narrative (of a return to an an old Britain that some voters found appealing) and while the Remain side argued that this narrative was not plausible in today’s world, its counter consisted mostly of numbers (the costs that Britain would face from Brexit). Looking ahead to similar referendums in other EU countries, I am afraid that the same dynamic is going to play out, since few politicians in any EU country seem to want to make a full-throated defense of being Europeans first.

Democracy can disappoint (you): The parallels between political and corporate governance are plentiful and Brexit has brought to the surface the age-old debate about the merits of direct democracy. While some (mostly on the winning side) celebrate the power of free will, those who have never trusted people to make reasoned judgments on their futures view the vote as vindication of their fears. In corporate governance, this tussle has been playing out for a while, with those who believe that shareholders, as the owners of public corporations, should control outcomes, at one end, and those who argue that incumbent managers and/or insiders are more knowledgeable about businesses and should therefore be allowed to operate unencumbered, at the other. I am sure that there are many in the corporate world who will look at the Brexit results and cheer for the Facebook/Google model of corporate governance, where shares with different voting rights give insiders control in perpetuity. As someone who has argued strongly for corporate democracy and against entrenching incumbent managers, it would be inconsistent of me to find fault with the British public for voting for Brexit. In a democracy, you will get outcomes you do not like and throwing a tantrum (as some in the Remain camp are doing right now) or threatening to move (to Canada or Switzerland) are not grown-up responses. You may not like the outcome, but as an American political consultant said after his candidate lost an election, “the people have spoken… the bastards”.

The End Game

I have not bought or sold anything since the Brexit results for the simple reason that almost anything I do in the midst of a panic is more likely to be counter productive than helpful. To those who would argue that I should move my money away from Europe, the markets have already done that for me (by marking down my European stocks) and I see little to be gained by overdoing it. To those who assert that this is the time to buy, I am not a fan of blind contrarianism but I will be looking at UK-based companies that have significant non-European operating exposure in the hope that markets have knocked down their prices too much. Finally, to those who posit that this is a financial meltdown, I will keep a wary eye on the numbers, looking for early signs that the worst case scenario is playing out. In my view, bank stocks will be the canaries in the coal mine, and especially so if the damage spreads to non-UK banks, and I will continue to estimate equity risk premiums for the S&P 500 and perhaps add the UK and Germany to the list to get a measure of how equity markets are repricing risk.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply