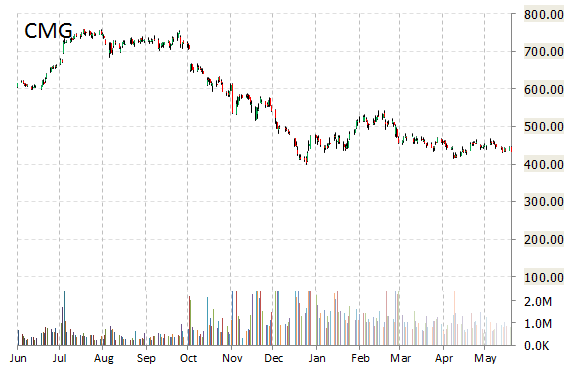

Chipotle Mexican Grill, Inc. (CMG) was reiterated as ‘Sell’ with a $285 from $300 price target on Wednesday by Maxim Group.

CMG shares are currently priced at 40.50x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 23.42x earnings multiple. The company’s current year and next year EPS growth estimates stand at (68.10%) and 146.50% compared to the industry growth rates of 12.40% and 15.40%, respectively. CMG has a t-12 price/sales ratio of 2.98. EPS for the same period registers at 10.51. CMG was down 7.75 points or 1.79% to $425.64 as of 1:38 PM ET.

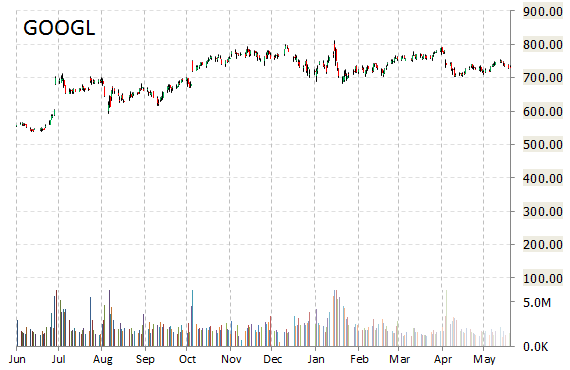

Alphabet Inc. (GOOGL) rating of ‘Overweight’ was reiterated today at Morgan Stanley with a price target increase of $865 from $850 (versus a $731.09 previous close).

On trading-measure, GOOGL has a beta of 0.91 and a short float of 3,430,800. In the past 52 weeks, Alphabet shares have traded between a low of $539.21 and a high of $810.35 with its 50-day MA and 200-day MA located at $731.94 and $744.91 levels, respectively. GOOGL currently prints a one year return of about 34.52% and a year-to-date loss of around 6.03%. GOOGL shares are up $10.21, or over 1.40%, at $741.30.

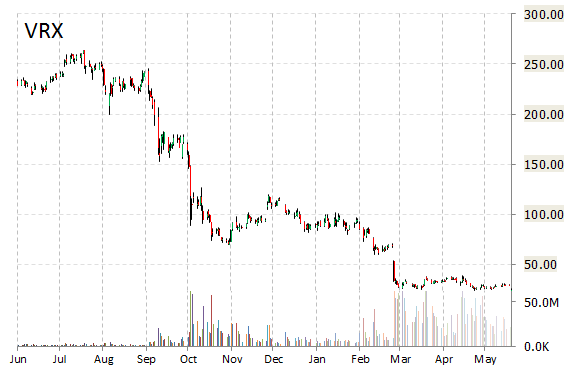

Valeant Pharmaceuticals International, Inc. (VRX) was reiterated a ‘Buy’ by Stifel analysts on Wednesday. The broker also cut its price target on the stock to $55 from $65.

In the past 52 weeks, shares of the pharmaceutical company have traded between a low of $22.52 and a high of $263.81 with the 50-day MA and 200-day MA located at $30.13 and $64.00 levels, respectively. Additionally, shares of VRX trade at a P/E ratio of 0.31 and have a Relative Strength Index (RSI) and MACD indicator of 35.36 and (1.52), respectively. VRX shares are lower by nearly 2.23% to $24.09 in mid-day trading.

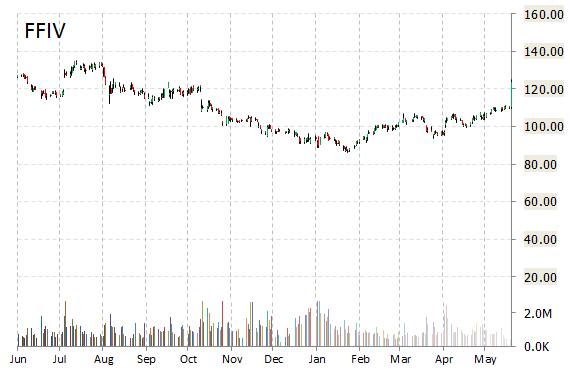

Shares of F5 Networks, Inc. (FFIV) are down $2.42 to $121.52 in mid-day trading after MKM Partners reiterated its ‘Neutral’ rating and increased its 12-month base case estimate on the name by 12 points to $118 a share.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply