Sagent Pharmaceuticals‘ (SGNT) stock jumped nearly 15% in early trading following a Reuters report saying the company is exploring a sale. The publication notes Sagent is working with investment bank Perella Weinberg Partners, which has reached out to other companies and private equity firms to solicit interest in a possible deal.

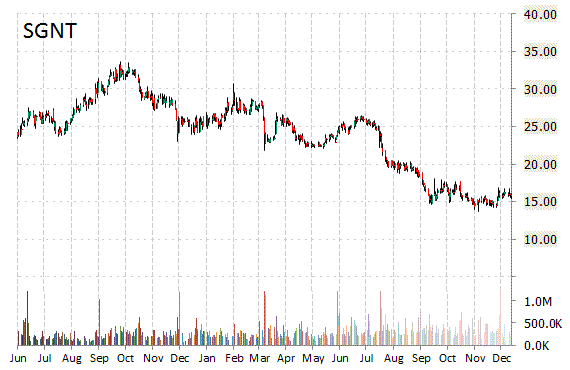

Shares of Sagent went up following the news, reaching an intraday high of $15.43 after closing at $13.27. Approximately 1.3 million shares have already changed hands, compared to the stock’s average daily volume of 409K shares.

Fundamentally, SGNT shows the following financial data:

- $46.01 million in cash in most recent quarter

- $381.49 million t-12 total assets

- $275.75 million total equity

- $318.75 million t-12 revenue

- $39.88 million annual net income

- $18.94 million free cash flow

On valuation measures, Sagent Pharmaceuticals Inc. shares have a T-12 price/sales ratio of 1.36, and a price/book for the same period of 1.59. EPS is $0.79. The name has a market cap of $242.70 million and a median Street price target of $20.00 with a high target of $28.00. Currently there are 4 analysts that rate SGNT a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’.

In terms of share statistics, Sagent has a total of 32.79 million shares outstanding, with 27.74% held by insiders and 76.80% held by institutions. The stock’s short interest currently stands at 7.75%, bringing the total number of shares sold short to 1.93 million.

Shares of Schaumburg, Illinois-based specialty pharmaceutical company are down 48.12% year-over-year, and 16.59% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply