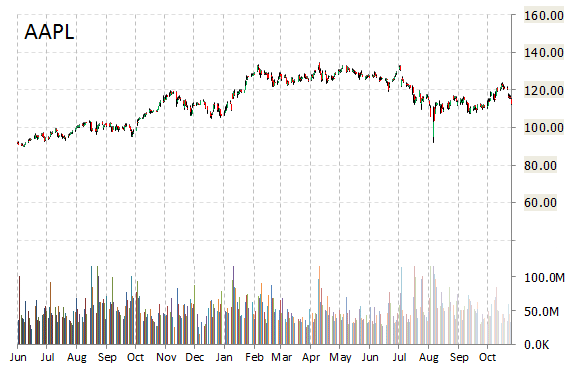

Shares of Apple Inc. (AAPL) gained 1.14% in early trade Monday despite a Credit Suisse (CS) report which indicated the Cupertino has cut its orders for iPhone 6s components by as much as 10 percent.

Shares of the $632.80 billion market cap iPhone maker are up 1.27% year-over-year and 3.51% year-to-date.

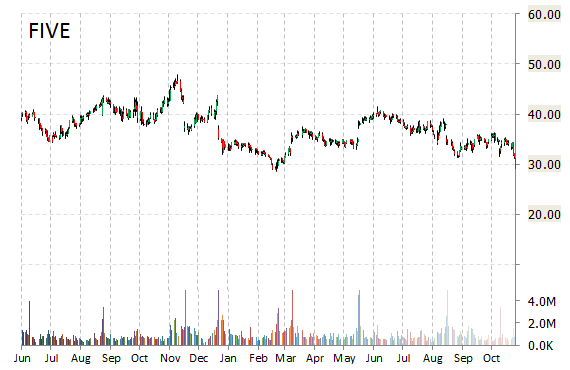

Five Below, Inc. (FIVE) was downgraded from ‘Buy’ to ‘Hold’ at Deutsche Bank (DB). The banking giant also cut its price target on the name to $30 from $42. The downgrade was based on weak traffic likely leading to multiple contraction.

Shares have traded today between $27.10 and $28.59 with the price of the stock fluctuating between $27.10 to $47.89 over the last 52 weeks.

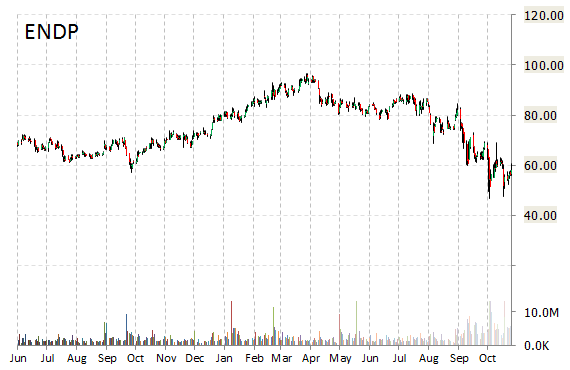

Mizuho reported on Monday that they have lowered their rating for Endo International plc (ENDP). The firm has downgraded ENDP from ‘Buy’ to ‘Neutral’ and lowered its price target to $55 from $82.

Endo Int’l recently traded at $56.58, a loss of $1.41 over Friday’s closing price. The name has a current market capitalization of $12.80 billion.

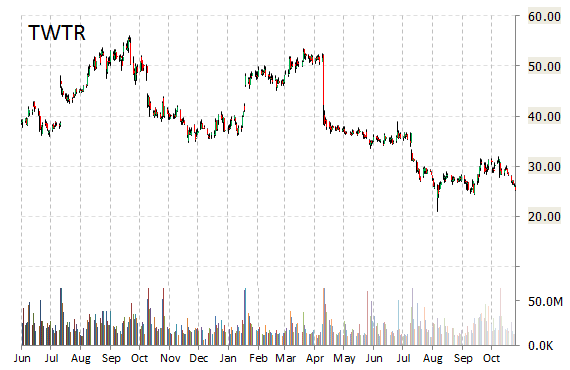

Twitter, Inc. (TWTR) was reiterated a ‘Neutral’ by MKM Partners analysts on Monday. The broker however, cut its price target on the stock to $29 from $31, noting that while there is significant potential for upside long-term, user experience efforts take time and the event-path is otherwise lacking in the near-term.

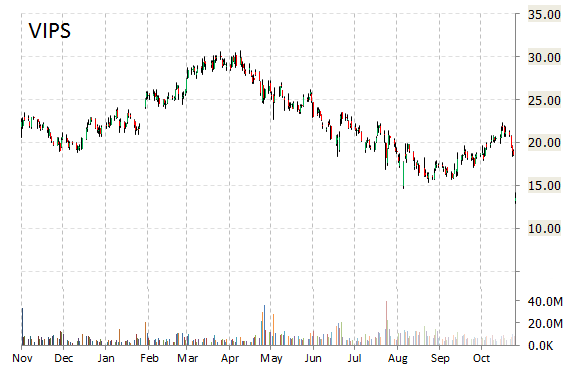

Vipshop Holdings Limited (VIPS) had its rating lowered from ‘Buy’ to ‘Neutral’ by analysts at BofA/Merrill (BAC) on Monday.

VIPS was down $0.96 at $12.64 in mid-day trade, moving within a 52-week range of $12.02 to $30.72. The name, valued at $7.33 billion, opened at $13.69. Currently there are 24 analysts that rate VIPS a ‘Buy’ vs. one rating it a ‘Hold’. No analyst rates it a ‘Sell’.

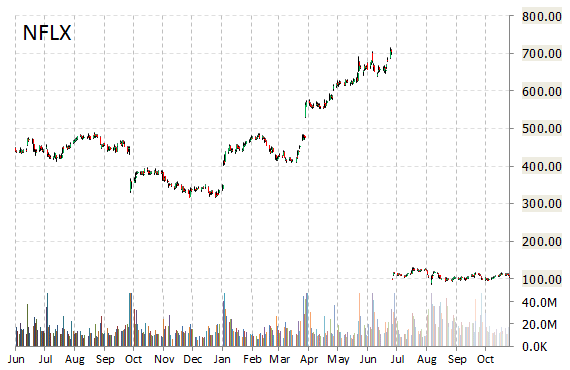

Netflix, Inc. (NFLX) was reiterated as ‘Buy’ but with a $142 from $161 price target on Monday by Topeka Capital Markets.

NFLX was up $5.59 at $109.24 in midday trade, moving within a 52-week range of $45.08 to $129.29. The name, valued at $46.69 billion, opened at $102.97.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply