Wells Fargo & Company (WFC) is scheduled to report Q315 results after the markets open tomorrow. The Street has consensus estimates of $1.04 in earnings per share and $21.75 billion in revenue. In the Q3 of the previous year, the banking giant posted $1.02 in EPS and $21.2 billion in revenue. Meanwhile, for the current quarter EarningsWhisper.com reports a whisper number of $1.05 per share.

As a quick reminder, WFC reported Q215 EPS of $1.03, $0.01 better than the Street’s consensus estimate of $1.02.

Fundamentally, WFC shows the following financial data:

- $332.47 billion in cash in most recent quarter

- $1.7T t-12 total assets

- $185.26 billion total equity

- $83.49 billion t-12 revenue

- $23.06 billion annual net income

- $6.34 billion free cash flow

On valuation measures, Wells Fargo & Co. shares have a T-12 price/sales ratio of 3.21 and a price/book for the same period of 1.58. EPS is $4.11. The name has a current market cap of $265.96 billion and a median Street price target of $59 with a high target of $67. Currently there are 16 analysts that rate WFC a ‘Buy’, 11 rate it a ‘Hold’. Three analysts rate it a ‘Sell’.

In terms of share statistics, Wells Fargo has a total of 5.13 billion shares outstanding with 0.08% held by insiders and 78.30% held by institutions. The stock’s short interest currently stands at 0.75%, bringing the total number of shares sold short to 38.41 million.

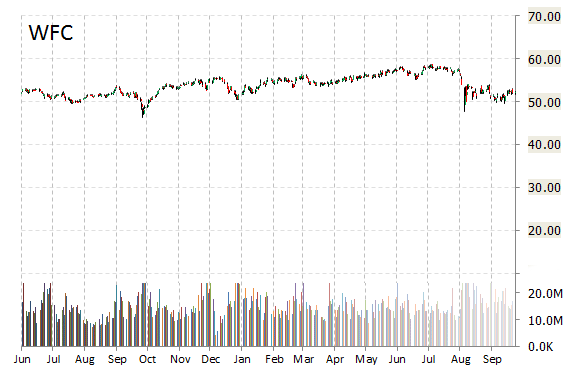

Offering a dividend yield of 2.89%, shares of San Francisco, California-based bank are up 6.07% year-over-year ; down 3.50% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply