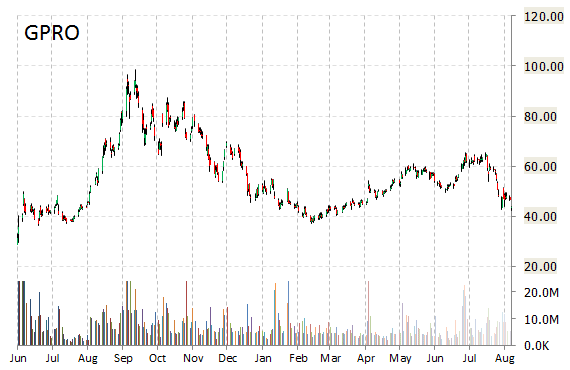

In a report published Wednesday, Piper Jaffray analysts lowered their GoPro, Inc. (GPRO) price target to $31.00 from $32.00. Separately, the name’s estimates were trimmed at Stifel following Ambarella’s (AMBA) guidance. The maker of video processing chips is one of GoPro’s key suppliers.

On valuation measures, GoPro Inc. stock it’s trading at a forward P/E multiple of 18.87x, and at a multiple of 36.22x this year’s estimated earnings. The t-12-month revenue at GoPro Inc. is $1.70 billion. GPRO ‘s ROE for the same period is $41.58%.

Shares of the $5.38 billion market cap company are down 19.00% year-over-year and 30.89% year-to-date.

GoPro Inc., currently with a median Wall Street price target of $73.50 and a high target of $105.00, dropped $3.19 to $40.46 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

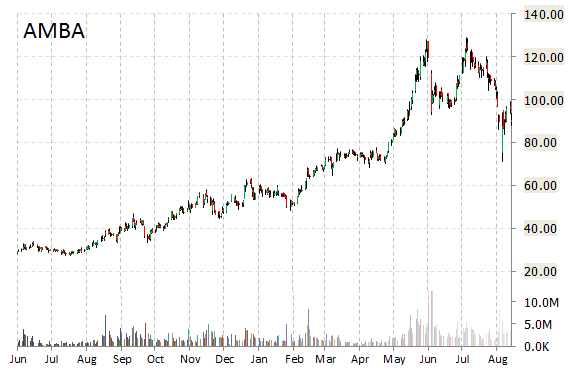

Ambarella, Inc. (AMBA) was reiterated a ‘Hold’ by Deutsche Bank (DB) analysts on Wednesday. The banking giant however, cut its price target on the stock to $85 from $100. Canaccord Genuity also lowered their price target on the name to $105 from $122 noting that for the first time in recent memory, AMBA’s guidance was slightly below consensus.

Shares have traded today between $75.01 and $83.00 with the price of the stock fluctuating between $33.35 to $129.19 over the last 52 weeks.

Ambarella Inc. shares are currently changing hands at 39.73x this year’s forecasted earnings, compared to the industry’s 14.55x earnings multiple. Ticker has a t-12 price/sales ratio of 11.31. EPS for the same period registers at $1.95.

Shares of Ambarella have lost $11.53 to $78.08 in mid-day trading on Wednesday, giving it a market cap of $2.43 billion. The stock traded as high as $129.19 in July 23, 2015.

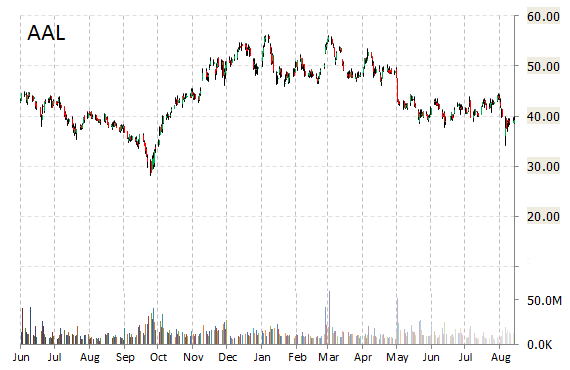

American Airlines Group Inc. (AAL) was reiterated as ‘Outperform’ with a $65 from $73 price target on Wednesday by Imperial Capital.

American Airlines Group Inc. recently traded at $40.87, a gain of $1.67 over Tuesday’s closing price. The name has a current market capitalization of $27.46 billion.

As for passive income investors, the company pays shareholders $0.40 per share annually in dividends, yielding 1.02%.

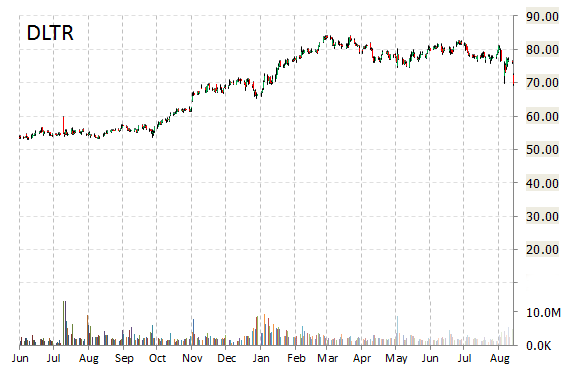

Dollar Tree, Inc. (DLTR) rating of ‘Hold’ was reiterated today at Deutsche Bank with a price target decrease of $73 from $81 (versus a $69.65 previous close).

Currently, there are 9 analysts that rate DLTR a ‘Buy’, 1 analyst rates it a ‘Sell’, and 8 rate it a ‘Hold’.

DLTR was down $1.88 at $67.77 in mid-day trade, moving within a 52-week range of $53.70 to $84.22. The name, valued at $15.90 billion, opened at $70.24.

On valuation measures, Dollar Tree Inc. shares are currently priced at 26.37x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.64. EPS for the same period registers at $2.57.

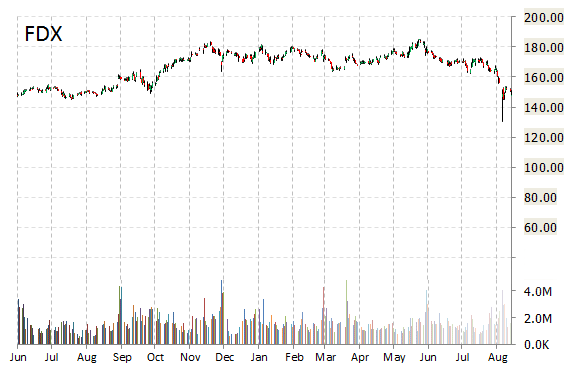

FedEx Corporation (FDX) was reiterated as ‘Buy’ with a price target decrease of $206 from $216 at Deutsche Bank.

FDX was up $1.22 at $149.25 in mid-day trade, moving within a 52-week range of $130.13 to $185.19. The name, valued at $42.16 billion, opened at $150.08.

On valuation measures, FedEx Corp. shares are currently priced at 40.89x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 0.88. EPS for the same period registers at $3.65.

As for passive income investors, the firm pays stockholders $1.00 per share annually in dividends, yielding 0.56%.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply