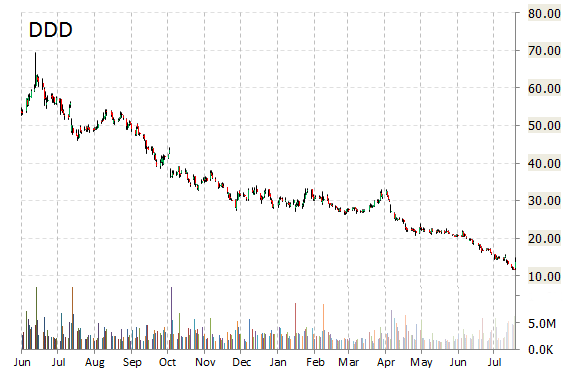

Analysts at Piper Jaffray are out with a report this morning upgrading shares of 3D Systems Corporation (DDD) with a ‘Neutral‘ from ‘Underweight‘ rating.

On valuation measures, 3D Systems Corp. shares have a forward P/E of 17.42 and t-12 price-to-sales ratio of 2.28. EPS for the same period is ($0.06).

In the past 52 weeks, shares of Rock Hill, South Carolina-based company have traded between a low of $11.66 and a high of $54.24 and are now at $13.34. Shares are down 71.54% year-over-year and 58.62% year-to-date.

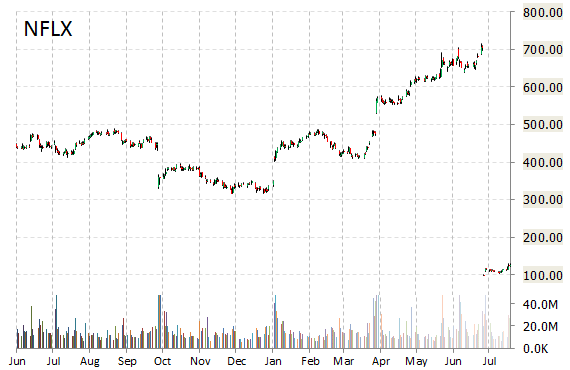

In a report published Friday, Pivotal Research reiterated a ‘Buy’ rating on Netflix, Inc. (NFLX), and raised the price target from $155 to $175 noting that as the online video streaming provider “adds compelling (mostly original) content while maintaining the current pricing structure they are effectively driving the perceived price down for consumers for an entertainment experience that continues to improve.”

On valuation measures, Netflix Inc. shares are currently priced at 276.48x this year’s forecasted earnings compared to the industry’s 16.19x earnings multiple. Ticker has a PEG and forward P/E ratio of 25.22 and 409.17, respectively. Price/Sales for the same period is 8.81 while EPS is $0.45. Currently there are 20 analysts that rate NFLX a ‘Buy‘, 14 rate it a ‘Hold‘. 4 analyst rates it a ‘Sell‘. NFLX has a median Wall Street price target of $120.00 with a high target of $160.00.

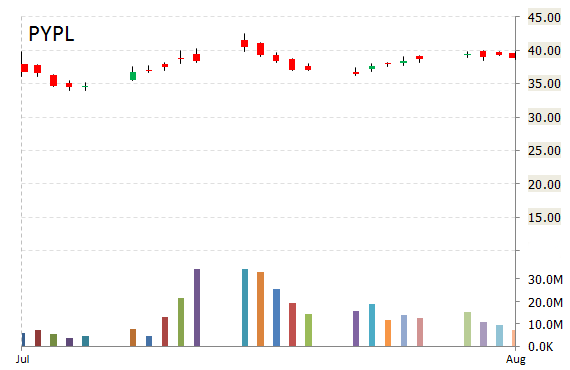

In a report published Friday, Topeka Capital Markets analysts initiated coverage on PayPal Holdings, Inc. (PYPL) with a ‘Buy‘ rating and $44 price target noting the name, post-spin, remains undervalued relative to peers and offers a compelling medium to long-term value for investors.

PYPL recently lost $0.18 to $38.67. Since its July 20 split from parent company eBay (EBAY), shares of PayPal have traded between a low of $33.98 and a high of $42.55. Shares are up 5.83% year-to-date.

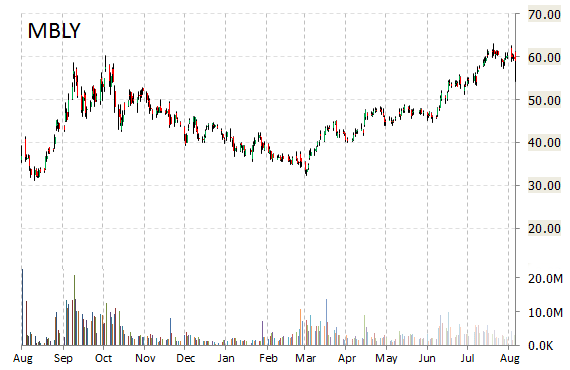

Goldman Sachs (GS) is out with a report this morning raising shares of Mobileye N.V. (MBLY) to $70 from $52, implying 19% expected return from the stock’s current price.

MBLY recently lost $0.49 to $58.68. The stock is up 62% year-over-year and has gained roughly 46% year-to-date. In the past 52 weeks, shares of the Israeli-based company have traded between a low of $31.11 and a high of $63.17.

Mobileye N.V. closed Thursday at $59.11. The name has a current market cap of $12.72 billion.

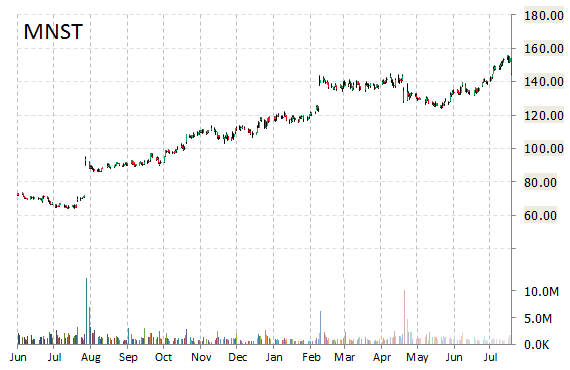

Monster Beverage Corporation (MNST) was reiterated a ‘Outperform’ by RBC Capital Markets analysts on Friday. The broker also raised its price target on the stock to $166 from $152.

Monster Beverage Corporation shares are currently priced at 64.99x this year’s forecasted earnings compared to the industry’s 27.74x earnings multiple. Ticker has a PEG and forward P/E ratio of 2.07 and 36.23, respectively. Price/Sales for the same period is 9.65 while EPS is 2.25. Currently there are 9 analysts that rate MNST a ‘Buy’ whereas 7 rate it a ‘Hold’. No analyst rates it a ‘Sell’. MNST has a median Wall Street price target of $151.00 with a high target of $167.00.

Over the past year, shares of Corona, California-based company have traded between a low of $68.49 and a high of $155.83 and are now at $146.35. Shares are up 119.37% year-over-year and 33.71% since the beginning of the year.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply