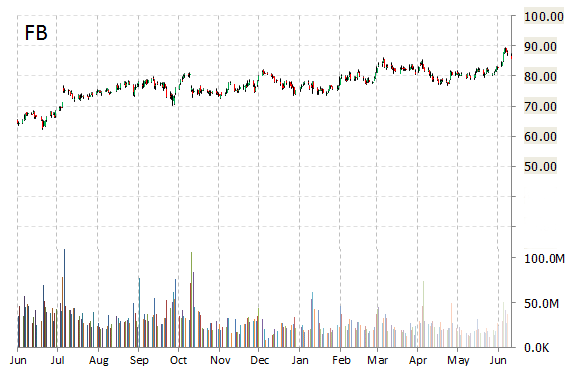

Facebook, Inc. (FB) was reiterated a ‘Buy’ by BofA/Merrill (BAC) analysts on Tuesday. The broker also raised its price target on the stock to $105 from $95.

On valuation measures, Facebook Inc. Cl A stock it’s trading at a forward P/E multiple of 32.50x, and at a multiple of 83.39x this year’s estimated earnings. The t-12-month revenue at Facebook is $13.51 billion. FB ‘s ROE for the same period is 10.36%.

Shares of the $241.44 billion market cap company are up 26.92% year-over-year and 9.97% year-to-date.

Facebook Inc, currently with a median Wall Street price target of $95.00 and a high target of $120.00, rose $0.37 to $86.15 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

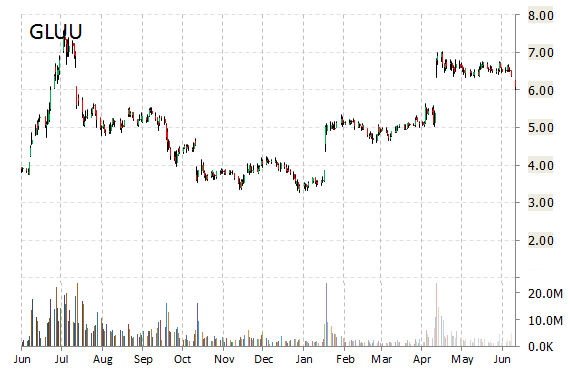

Glu Mobile, Inc. (GLUU) was reiterated as ‘Buy’ with a $10 from $8 price target on Tuesday by Craig Hallum.

GLUU shares recently gained $0.09 to $6.18. In the past 52 weeks, shares of the developer of games for the smartphones and tablet devices users have traded between a low of $3.27 and a high of $7.60. Shares are up 30.41% year-over-year and 56.15% year-to-date.

In a report published Tuesday, RBC Capital Markets analysts initiated coverage on Fitbit Inc. (FIT) with an ‘Outperform‘ rating and $45 price target.

On valuation measures, Fitbit Inc. shares currently have a PEG and forward P/E ratio of 1.99 and 38.22, respectively. Price/sales for the same period is 7.03 while EPS is $1.48. Currently there are 2 analysts that rate FIT a ‘Buy’ versus no analyst rating it a ‘Sell’. FIT has a median Wall Street price target of $36.00 with a high target of $44.00.

Since its IPO, shares of San Francisco, California-based provider of wearable fitness-tracking devices have traded between a low of $29.50 and a high of $40.45 and are now at $35.38. Shares are up 12.13% year-to-date.

—

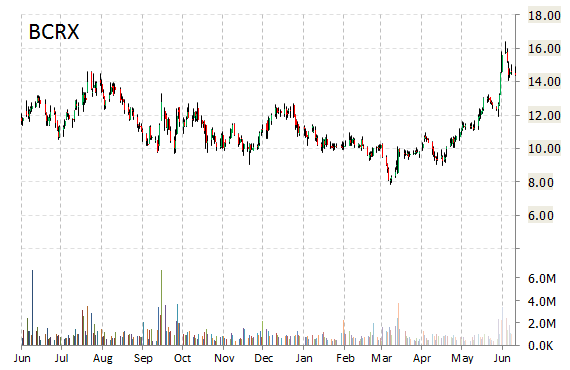

BioCryst Pharmaceuticals, Inc. (BCRX) was upgraded to ‘Buy‘ from ‘Neutral‘ by BofA/Merrill (BAC) analysts on Tuesday. The broker also raised its price target on the stock to $19 from $12, implying 27% expected upside from the stock’s current price.

The stock began trading this morning at $15.05 to currently trade 5.83% higher from the prior days close of $14.42. On an intraday basis it has gotten as low as $15.05 and as high as $15.67.

BCRX shares have advanced 28.64% in the last 4 weeks and 68.26% in the past three months. Over the past 5 trading sessions the stock has lost 8.56%.

The Birmingham, Alabama-based company, which is currently valued at $1.11 billion, has a median Wall Street price target of $18.00 with a high target of $24.00. BioCryst Pharmaceuticals Inc. is up 15.18% year-over-year, compared with a 4.27% gain in the S&P 500.

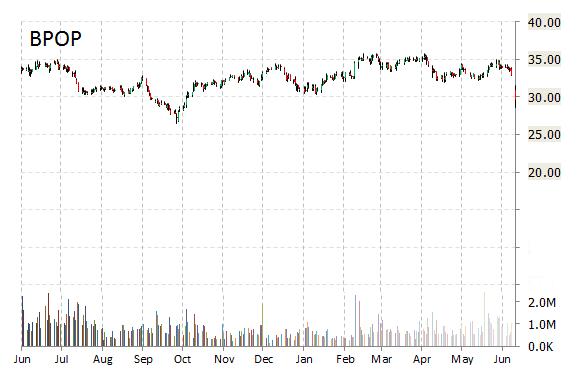

Analysts at Morgan Stanley (MS) upgraded their rating on the shares of Popular, Inc. (BPOP). In a research note published on Tuesday, the firm lifted the name with a ‘Equal-Weight‘ from ‘Underweight‘ rating and set a 12-month base case estimate of $31 per share.

On valuation measures, Popular Inc. shares have a PEG and forward P/E ratio of 2.01 and 7.46, respectively. Price/Sales for the same period is 2.75 while EPS is ($3.2). Currently there are 4 analysts that rate BPOP a ‘Buy‘ versus one analyst rating it a ‘Sell‘. BPOP has a median Wall Street price target of $39.00 with a high target of $41.00.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply