Billionaire activist investor Carl Icahn has sold last of his Netflix Inc. (NFLX) position, he disclosed in a tweet on Wednesday, saying “sold last of our NFLX today. Believe Apple (AAPL) currently represents same opportunity we stated NFLX offered several years ago.”

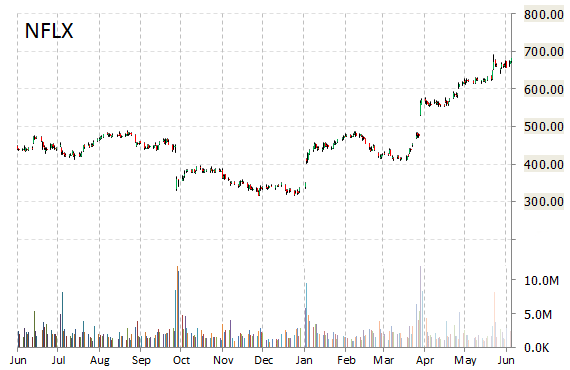

Netflix, Inc. is currently printing a higher than average trading volume with the issue trading 4.02 million shares, compared to the average volume of 2.57 million. The stock began trading this morning at $700.50 to currently trade 12 points higher from the prior days close of $681.19. On an intraday basis it has gotten as low as $687.00 and as high as $706.24.

NFLX shares are priced at 181.27x this year’s forecasted earnings, which makes them expensive compared to the industry’s 16.89x earnings multiple. The company’s current year and next year EPS growth estimates stand at -62.60% and 144.90% compared to the industry growth rates of 16.60% and 21.50%, respectively. NFLX has a t-12 price/sales ratio of 7.11. EPS for the same period registers at 3.84.

NFLX shares have advanced 9.54% in the last 4 weeks and 55.42% in the past three months. Over the past 5 trading sessions the stock has gained 2.14%. The Los Gatos, Calif.-based company, which is currently valued at $42.17 billion, has a median Wall Street price target of $605.00 with a high target of $950.00. NFLX is up 54.98% year-over-year and 99.41% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply