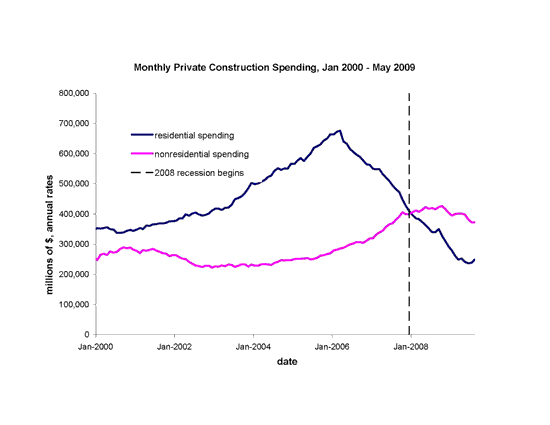

Here’s an update to a chart I have shown regularly. Housing PRICES showed a bottom a while ago. Due to crowding out from the fiscal stimulus, it was expected that a housing recovery would be more visible in housing prices than in housing CONSTRUCTION. Nevertheless, it would not be a housing recovery unless construction increased to more normal levels, which is why I have watched the construction activity closely.

I have expected non-residential construction to be high, and it is compared to most of 2007 and all of the years before that. But it appears that construction spending now is just a bit lower than it was when the recession began.

Note that this graph is construction SPENDING, which differ from the VOLUME of construction according to construction prices. 2009’s construction prices must be especially low, so a time series for the volume of construction activity should show 2009 to be less below prior years’ than shown by the spending series.

Professor Delong Sets the Table for Multiplier Measurement

Professor DeLong explains how government spending should have essentially the same multiplier as housing construction spending:

“Shocks to spending boost nominal demand: whenever any significant group decides to boost their spending nominal demand rises, whether that group is new businesses seeking to profit from technological progress in high-tech in the 1990s, construction companies that find they can obtain cheap financing via derivatives in 2004, or the U.S. government in 2009. The government’s money is as good as anyone’s.” (emphasis added)

If he’s right, then we could look at the effects of housing construction spending to learn about the controversial government spending multiplier. Furthermore, Professor explained to us (above) how the housing boom and bust are especially interesting autonomous spending changes (that is, changes well suited for measuring multipliers). So let’s look: (see chart above)

During the boom, I see an obvious crowding out (as opposed to the “crowding in” claimed by Professor Krugman): more housing construction was reducing non-residential construction, not increasing it. Remember that the multiplier advocates claim that spending in one sector motivates spending in another.

During the early part of the bust — though the end of 2008, and thus through 12 months of recession — I also see a clear crowding out: less housing construction was increasing non-residential construction. That non-residential construction spending increase did not need a spending boom in the housing or any other sector to get going (Krugman’s view) but rather needed LESS spending in other areas.

Even during 2009, it’s difficult to see housing spending drops doing much to significantly pulling down non-residential spending. To the degree that non-residential spending fell, it may be due to crowding out by public construction spending (not shown in the graph) … when I get some numbers on this I’ll let you know.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply