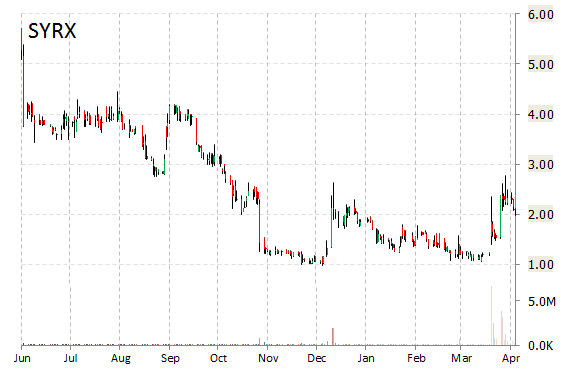

Sysorex Global Holdings Corp. (SYRX) shares are exploding higher by more than 34% to $2.80 Thursday after the company announced that its Lilien Systems division has been selected as one of the 65 Prime Contract Holders under the Chief Information Officer – Commodities and Solutions (CIO-CS) contract by National Institutes of Health Information Technology Acquisition and Assessment Center (NITAAC).

Sysorex said the CIO-CS, a multiple-award Government-Wide Acquisition Contract, is a 10 year Indefinite Delivery/Indefinite Quantity contract with a maximum value of $20 billion with a one 60-month base period from May 1, 2015 to April 30, 2020; and one 60-month option period from May 1, 2020 to April 30, 2025. As a CIO-CS Prime Contract Holder, Lilien is among a handful of companies allowed to fulfill task orders from federal, civilian or DoD agencies seeking to acquire IT commodities and solutions.

During today’s trading session, SYRX opened sharply higher to reach an intraday high of $3.07 with the name’s 52-week range being $0.98 to $6.21. Approximately 3.1 million shares have already changed hands, compared to the stock’s average daily volume of 945K shares.

Fundamentally, SYRX shows the following financial data:

- $3.23 million in cash in most recent quarter

- $62.06 million t-12 total assets

- $29.22 million total equity

- $62.95 million t-12 revenue

- ($7.54) million annual net income

- ($5.59) million free cash flow

On valuation measures, Sysorex Global Holdings Corp. shares have a T-12 price/sales ratio of 0.66 and a price/book for the same period of 1.34. EPS is ($0.41). The name has a market cap of $56.01 million and a median Wall Street price target of $2.50.

In terms of share statistics, Sysorex Global Holdings Corp. has a total of 19.79 million shares outstanding with 3.52% held by insiders and 1.40% held by institutions. The stock’s short interest currently stands at 1.14%, bringing the total number of shares sold short to 127,153.

Shares of the Palo Alto California-based company are down 60.19% year-over-year ; up 2.45% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply