CSX Corp. (CSX) reported first quarter EPS of $0.45 in the extended session Tuesday, compared to the consensus estimate of $0.44. Revenues declined 4% from last year to $3.00 billion. Analysts expected revenues of $3.01 billion. The freight railroad said net earnings came in at $442 million, an 11% increase from $398 million in the same period last year. The stock is now up $1.48 to $34.69 on 17.4 million shares.

CSX also announced a new $2 billion share repurchase program and an increase of its quarterly dividend. The company said the 13% increase in the dividend, to $0.18 per share, is payable on June 15, 2015 to shareholders of record at the close of business on May 29, 2015. This is the 13th increase in 10 years.

On valuation measures, CSX Corp. shares, which currently have an average 3-month trading volume of 7.61 million shares, trade at a trailing-12 P/E of 17.30, a forward P/E of 14.09 and a P/E to growth ratio of 1.59. The median Wall Street price target on the name is $37.00 with a high target of $42.00. Currently ticker boasts 10 ‘Buy’ endorsements, compared to 18 ’Holds’ and no ‘Sell’.

Profitability-wise, CSX has a t-12 profit and operating margin of 15.21% and 28.52%, respectively.

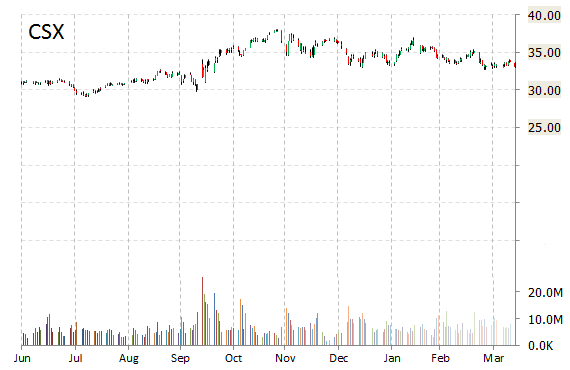

CSX currently prints a one year return of about 20.60% and a year-to-date loss of around 8.30%.

The chart below shows where the equity has traded over the last 52 weeks.

CSX Corporation provides rail-based transportation services in the U.S. and Canada. The company was founded in 1978 and is based in Jacksonville, Florida.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply