Oracle Corporation (ORCL) reported third quarter EPS of $0.68 after the closing bell Tuesday, compared to the consensus estimate of $0.68. Revenues increased 0.2% from last year to $9.33 billion. Analysts expected revenues of $9.45 billion. The stock is currently up $0.62 to $43.49 on 20.1 million shares.

Oracle said the greenback’s strengthening against foreign currencies had a significant impact on results in the quarter. Without the strengthening of the U.S. dollar, total revenues would have been up 6% as measured in constant currency.

Oracle also announced that its Board of Directors declared a quarterly cash dividend of $0.15 per share of outstanding common stock, reflecting a 25% increase over the current quarterly dividend of $0.12.

On valuation measures, Oracle Corp. shares, which currently have an average 3-month trading volume of 12.13 million shares, trade at a trailing-12 P/E of 17.83, a forward P/E of 13.52 and a P/E to growth ratio of 1.76. The median Wall Street price target on the name is $47.75 with a high target of $52.00. Currently ticker boasts 19 ‘Buy’ endorsements, compared to 15 ’Holds’ and 2 ‘Sell’.

Profitability-wise, ORCL has a t-12 profit and operating margin of 28.07% and 39.14%, respectively. The $188.26 billion market cap company reported $13.7 billion in cash in its most recent quarter.

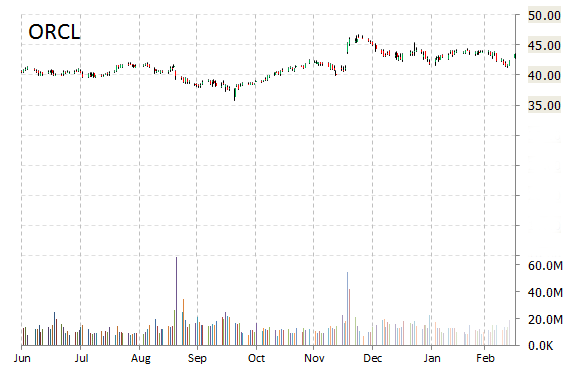

ORCL currently prints a one year return of about 17% and a year-to-date loss of around 3.20%.

The chart below shows where the equity has traded over the last 52 weeks.

Oracle Corp. is a developer and manufacturer of database and middleware software. The company was founded in 1977 and is headquartered in Redwood City, California.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply