JA Solar Holdings Co., Ltd. (JASO) reported fourth quarter EPS of $0.28 before the opening bell Thursday, compared to the consensus estimate of $0.26. Revenues increased 61.3% from last year to $576.4 million. Analysts expected revenues of $538.99 million. Net income was $26.8 million, compared to $22.5 million in the fourth quarter of 2013. The stock is currently up $0.30, or 3.33%, to $9.31/shr.

For full-year 2014, non-GAAP net income came in at $56.4 million, or $0.88 per share. Revenue was reported $1.8 billion, compared to $1.2 billion in fiscal year 2013. JA Solar said its 2014 shipments saw an increase of 47.6% from 2.1 GW in fiscal year 2013 to 3.1 GW.

Mr. Baofang Jin, chairman and CEO of JA Solar, commented, “Our results in Q4 confirm the visibility we had coming into the quarter. Demand in the China market was as strong as expected, as developers and utilities rushed to meet aggressive government-directed goals for the year..We grew non-GAAP earnings per ADS by 34% sequentially and 85% year over year.”

On valuation measures, JA Solar Holdings Co. Ltd. ADS shares, which currently have an average 3-month trading volume of 1.39 million shares, trade at a trailing-12 P/E of 7.57, a forward P/E of 5.85 and a P/E to growth ratio of 0.42. The median Wall Street price target on the name is $12.50 with a high target of $21.00. Currently ticker boasts 2 ‘Buy’ endorsements, compared to 3 ’Holds’ and no ‘Sell’.

Profitability-wise, JASO has a t-12 profit and operating margin of 4.18% and 5.05%, respectively. The $448.00 million market cap company reported $347.3 million in cash vs. $310.2 million in total long-term borrowings in its most recent quarter.

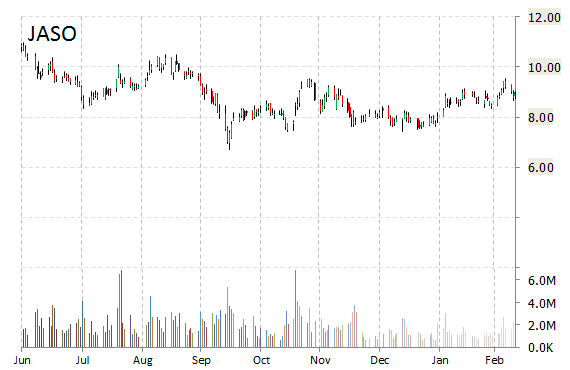

JASO currently prints a one year loss of about 14.76% and a year-to-date return of around 10.01%.

JA Solar Holdings Co. Ltd. is engaged in the design and sale of photovoltaic solar cells and solar power products based on crystalline silicon technologies. The company was founded in 2005 and is headquartered in Shanghai, China.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply