Costco Wholesale Corporation (COST) shares are up $3.83, or 2.60%, to $151.00 in pre-market trading Thursday after the company reported its second quarter earnings results.

The third-largest U.S. retailer reported earnings of $1.35 per share on revenues (which includes membership fees) of $27.45 billion, up 4.4% from a year ago. Analysts were expecting EPS of $1.18 on revenues of $27.52 billion. Net income for the fiscal Q2 ended February 15 climbed 29% to $598 million, or $1.35 per share, from $463 million, or $1.05 per share, a year earlier. The company said net profit was “positively impacted by a $57 million ($0.13 per diluted share) tax benefit in connection with February’s special cash dividend.”

Meanwhile, Q2 same-store sales for Costco climbed 2% in total and rose 4% in the U.S. Excluding the negative impacts from gasoline price deflation and foreign exchange, total and U.S. sales both surged 8%. In February, total sales increased 1%, but 8% when adjusted for fuel and currencies. Costco currently operates 671 warehouses, including 474 in the United States and Puerto Rico, 88 in Canada, 34 in Mexico, 26 in the United Kingdom, 20 in Japan, 11 in Korea, 10 in Taiwan, seven in Australia and one in Spain.

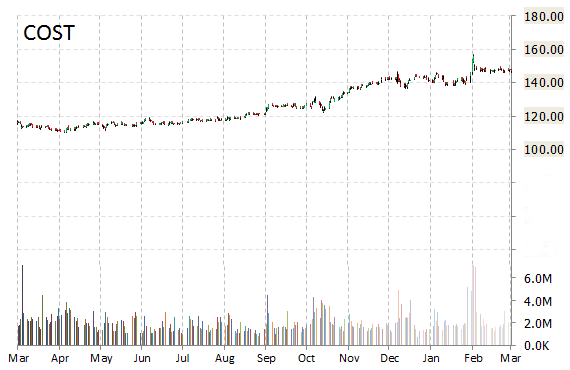

On valuation measures, Costco Wholesale Corp. shares, which currently have an average 3-month trading volume of 2.49 million shares, trade at a trailing-12 P/E of 30.60, a forward P/E of 25.96 and a P/E to growth ratio of 2.81. The median Wall Street price target on the name is $153.00 with a high target of $165.00. Currently ticker boasts 17 ‘Buy’ endorsements, compared to 8 ’Holds’ and 1 ‘Sell’.

Profitability-wise, COST has a t-12 profit and operating margin of 1.86% and 2.90%, respectively. The $64.83 billion market cap company reported $5.86 billion in cash vs. $3.83 billion in debt in its most recent quarter.

COST currently prints a one year return of about 31.80% and a year-to-date return of around 7.50%.

Costco Wholesale Corp. is an operator of membership warehouses. The company was founded in 1976 and is based in Issaquah, Washington.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply