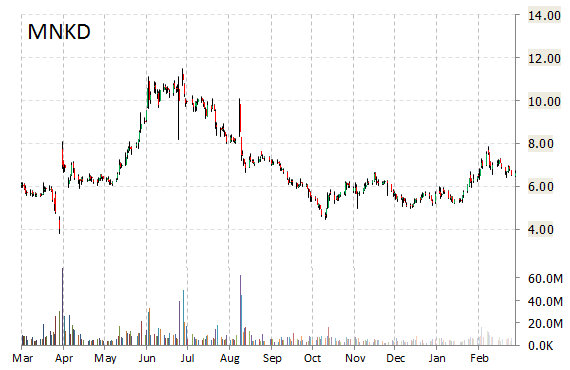

Analysts at Goldman (GS) downgraded MannKind Corp. (MNKD) from ‘Neutral‘ to ‘Sell‘ in a research report issued to clients on Tuesday.

Shares of the $2.44 billion market cap company are up 8.13% year-over-year and 28.35% year-to-date.

MannKind Corp., currently with a median Wall Street price target of $7.00 and a high target of $16.25, dropped $0.62 to $6.02 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

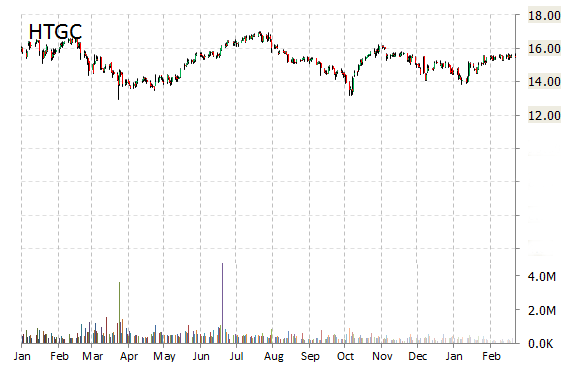

Hercules Technology Growth Capital, Inc. (HTGC) was downgraded from ‘Outperform‘ to ‘Market Perform‘ at Keefe Bruyette.

Shares have traded today between $14.11 and $15.14 with the price of the stock fluctuating between $12.95 to $16.99 over the last 52 weeks.

Hercules Technology Growth Capital Inc. shares are currently changing hands at 12.19x this year’s forecasted earnings, compared to the industry’s 26.39x earnings multiple. Ticker has a t-12 price/sales ratio of 7.11. EPS for the same period registers at $1.19.

Shares of HTGC have lost $1.06 to $14.44 in mid-day trading on Tuesday, giving it a market cap of roughly $926.98 million. The stock traded as high as $16.99 in July 29, 2014.

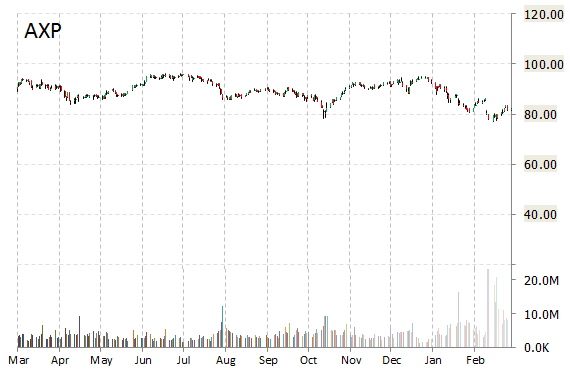

Macquarie reported on Tuesday that they have lowered their rating for American Express Company (AXP). The firm has downgraded AXP from ‘Neutral‘ to ‘Underperform‘ and cut its price target from $81 to $76.

American Express Co. recently traded at $81.59, a loss of $0.44 over Monday’s closing price. The name has a current market capitalization of $83.15 billion.

As for passive income investors, the firm pays shareholders $1.04 per share annually in dividends, yielding 1.30%. Five year average dividend yield currently stands at 1.30%.

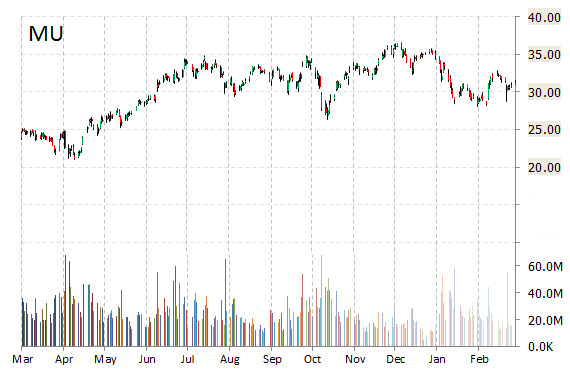

Micron Technology, Inc. (MU) had its rating lowered from ‘Buy‘ to ‘Neutral‘ by analysts at Nomura on Tuesday. Currently there are 23 analysts that rate MU a ‘Buy’, 1 analyst rates it a ‘Sell’, and 8 rate it a ‘Hold’.

MU was down $1.38 at $29.86 in mid-day trade, moving within a 52-week range of $21.02 to $36.59. The name, valued at $32.17 billion, opened at $30.37.

On valuation measures, Micron Technology Inc. shares are currently priced at 9.70x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.99. EPS for the same period registers at $3.08.

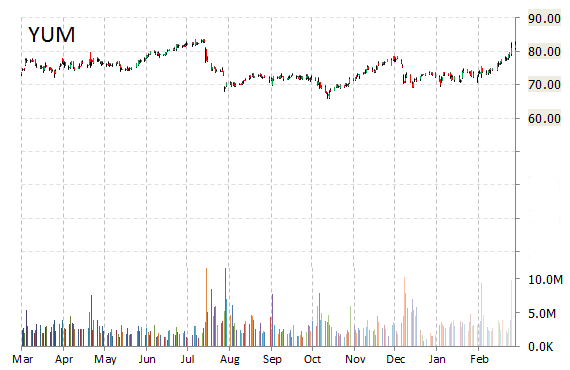

Yum! Brands, Inc. (YUM) was downgraded by Robert W. Baird from a ‘Outperform‘ rating to a ‘Neutral‘ rating in a research report issued to clients on Tuesday. They currently have a $84 price objective on the stock, 4 points up from their previous price target of $80.

YUM closed at $81.80 on Monday and is currently trading down $1.13.

In the past 52 weeks, shares of the operator of fast food restaurants have traded between a low of $65.81 and a high of $83.58 and are now trading at $80.67. Shares are up 12.78% year-over-year and 12.92% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply