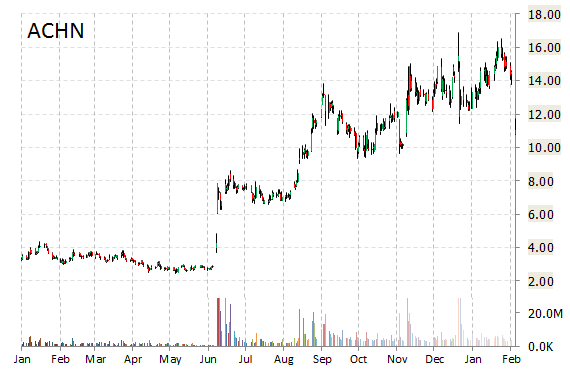

Shares of Achillion Pharmaceuticals, Inc. (ACHN) gained nearly 14% to $12.32 in Monday’s pre-market trading session, after the company announced positive Phase 2 ACH-3102 data.

“The ability to further shorten treatment duration to only six weeks and maintain excellent SVR12 rates remains the goal for clinicians and patients, and I am pleased that these Phase 2 results support that goal”, commented Professor Edward Gane, M.D., Deputy Director and Hepatologist, New Zealand Liver Transplant Unit, Auckland City Hospital in New Zealand.

On valuation-measures, shares of Achillion Pharmaceuticals, Inc. have a P/E to growth ratio and EPS of (0.93) and ($0.62), respectively. The company has a market cap of $1.08B and a median Wall Street price target of $22.00 with a high target of $25.00.

On trading-measure, ACHN has a beta of 1.40 and a short float of 18.10%. In the past 52 weeks, shares of New Haven, Connecticut-based biopharmaceutical firm have traded between a low of $2.45 and a high of $16.87 with its 50-day MA and 200-day MA located at $13.85 and $11.71 levels, respectively.

ACHN currently prints a one year return of about 250%, and a year-to-date loss of around 12%.

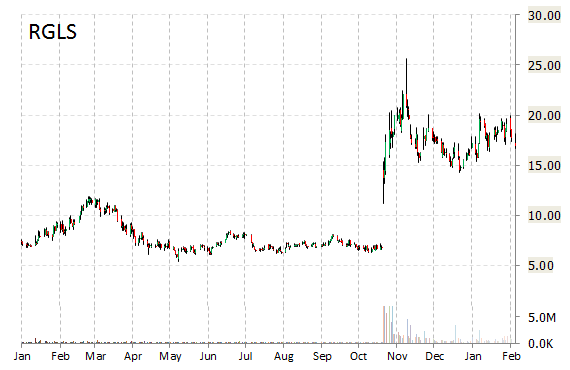

Regulus Therapeutics Inc. (RGLS) shares tumbled 19% in pre-market trade Monday despite news that all HCV patients treated with a pingle SC pdministration of 4 mg/kg of RG-101 responded with mean viral load reduction of 4.8 log10 at day 29 and 9/14 patients are below the limit of quantification at day 57.

“With the promising data reported today, our confidence in our ability to treat diseases with microRNA therapeutics is higher than ever and we look forward to continuing to execute our ‘Clinical Map Initiative’ goals for RG-101 and our microRNA therapeutics pipeline,” said in a statement Kleanthis G. Xanthopoulos, Ph.D., President and CEO of Regulus.

Regulus Therapeutics Inc was down 15.24% to $14.29 at 8:45 a.m. EST.

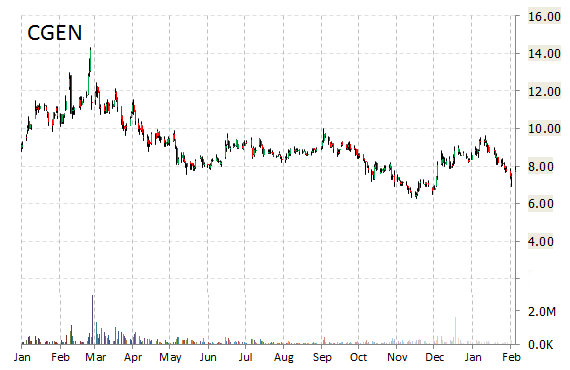

Compugen Ltd. (CGEN) gained 3.99% to $8.08 in pre-market trading after the company reported new results supporting CGEN-15049 as potential cancer immunotherapy target.

Compugen Ltd., currently valued at $380.93M, has a median Wall Street price target of $14.00 with a high target of $14.00. In the past 52 weeks, shares of therapeutic product discovery company have traded between a low of $6.27 and a high of $14.32 with the 50-day MA and 200-day MA located at $8.48 and $8.24 levels, respectively. Additionally, shares of CGEN have a Relative Strength Index (RSI) and MACD indicator of 40.31 and -0.30, respectively.

CGEN currently prints a one year loss of about 28%, and a year-to-date loss of around 7%.

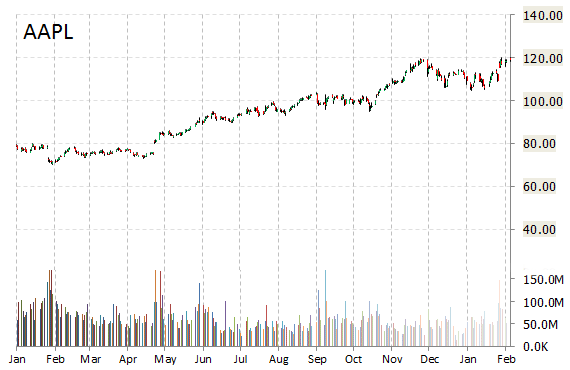

Apple (AAPL) – The tech giant plans to hold its first Swiss franc-denominated bond sale, according to Bloomberg. The publication said Goldman Sachs (GS) and Credit Suisse (CS) will manage the sale. By borrowing in Swiss francs, the iPhone maker wants to take advantage of record-low funding costs after Swiss government bond yields turned negative.

Apple Inc., currently valued at $692.74B, has a median Wall Street price target of $133.00 with a high target of $165.00. The name currently prints a one year return of about 65.53%, and a year-to-date return of around 8.20%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply