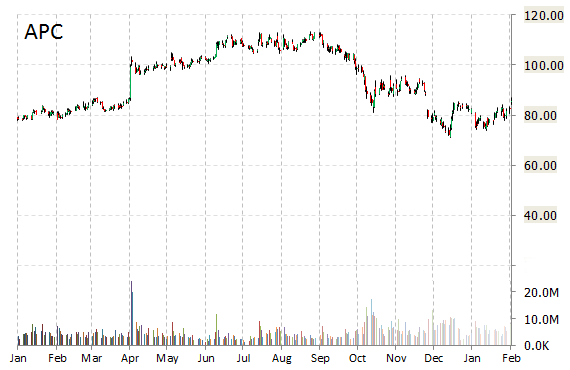

Analysts at Jefferies initiated coverage on Anadarko Petroleum Corporation (APC) with an ‘Hold’ rating in a research report issued to clients on Friday. The price of the oil and gas explorer declined 0.20% to $83.51 per share at the time of this writing around 1:40 in the afternoon in New York.

On valuation measures, Anadarko Petroleum Corporation shares have a PEG and forward P/E ratio of 29.89 and 39.87, respectively. Price/Sales for the same period is 2.59 while EPS is ($3.47). Currently there are 21 analysts that rate APC a ‘Buy’, 6 rate it a ‘Hold’. No analyst rates it a ‘Sell’. APC has a median Wall Street price target of $97.00 with a high target of $120.00.

In the past 52 weeks, shares of The Woodlands, Texas-based company have traded between a low of $71.00 and a high of $113.51. Shares are up 6.88% year-over-year, and 1.43% year-to-date.

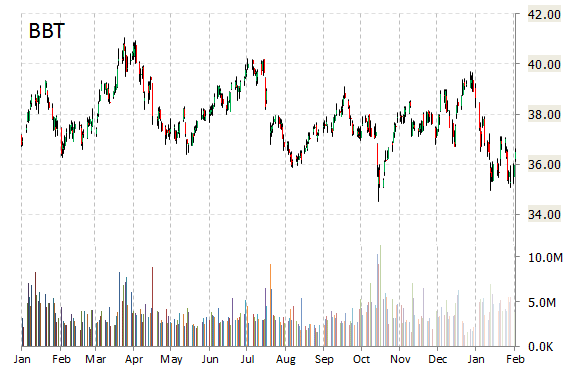

Investment analysts at Credit Suisse (CS) initiated coverage on shares of BB&T Corporation (BBT) in a note issued to investors on Friday. The firm set an ‘Outperform’ rating and a $44 price target on the stock. Credit’s price target would suggest a potential upside of 15% from the stock’s current pps.

BBT shares recently gained $1.19 to $38.28. In the past 52 weeks, shares of Winston-Salem, NC-based financial holding company have traded between a low of $34.50 and a high of $41.04. Shares are up 3.81% year-over-year ; down 4.63% year-to-date.

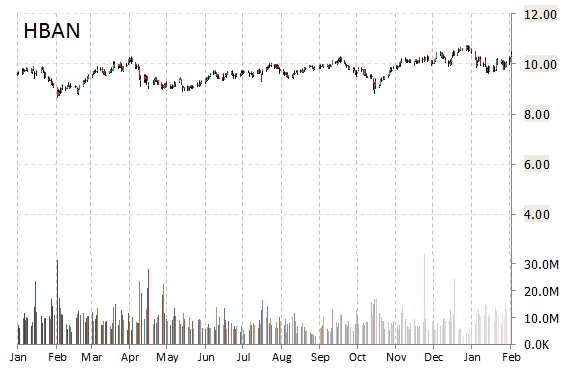

Credit Suisse (CS) is out with a report this morning initiating coverage of Huntington Bancshares Incorporated (HBAN) with a ‘Neutral’ rating and $11.50 price target, implying 10% expected return. Shares of Huntington Bancshares are trading up 1.50 percent to $10.46 in Friday’s midday trading session.

Shares in the $8.5 billion company are up 16% year-over-year ; down less than one percent year-to-date.

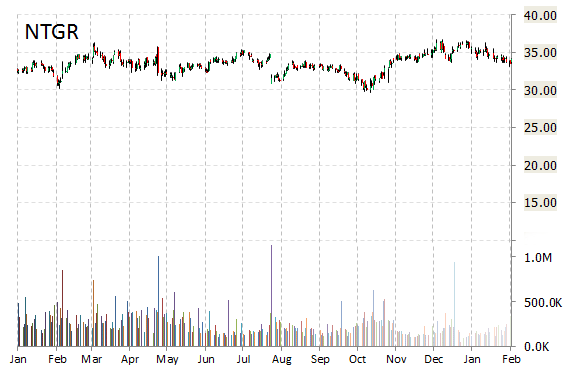

In a report published Friday, Credit Suisse (CS) initiated coverage on the maker of networking equipment Netgear Inc. (NTGR) with a ‘Sell’ rating. Separately, Netgear Inc. on Thursday reported a Q4 loss of $40.4 million, after reporting a profit in the same period a year earlier. Net revenue was $353.2 million, as compared to $356.6 million yoy. Guided Q1 revs below consensus.

Shares of Netgear were 10.46% lower in midday trading at $31.06. Shares have fallen 12.73% since the beginning of the year.

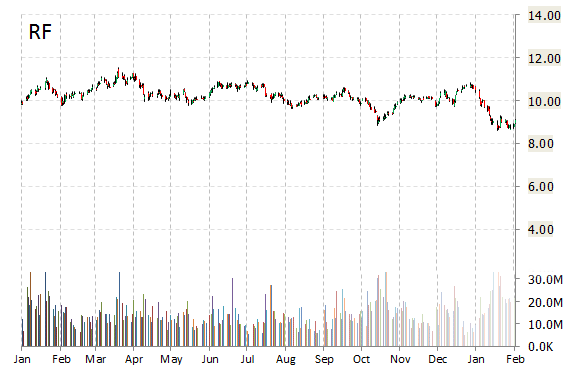

Investment analysts at Credit Suisse initiated coverage on shares of Regions Financial Corporation (RF) in a note issued to investors on Friday. The firm set a ‘Neutral’ rating and a $10.00 price target on the stock.

“Our target price of $10 equates to 1.1 times our forward tangible book value estimate, which we view as appropriate, given 2015E ROE of 7% and ROTE of 10%,” the firm wrote [via The Street] in its research note. “RF continues to make progress de-risking the loan portfolio, improving credit quality, and managing the NIM and expenses.”

Regions Financial shares recently rose 5% to $9.66, the highest level since January 13, 2015. The stock is down nearly 9% this year, and 6% year-over-year.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply