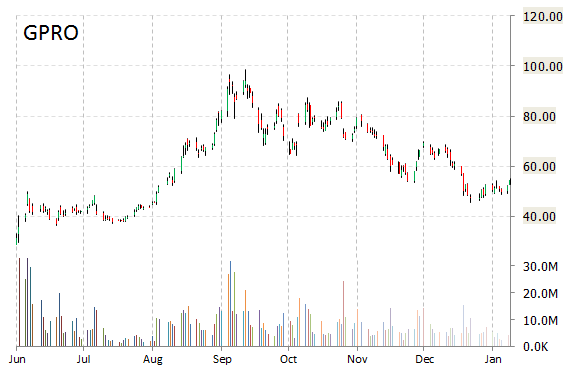

GoPro, Inc. (GPRO) is one of today’s notable stocks in decline, down as much as 13 percent. The maker of high definition cameras beat Q4 EPS minus items estimates by 29 cents on sales of $634 million vs. the Street consensus which called for EPS of 70 cents on sales of $580 million.

For Q1, GoPro forecast a profit of 15-17 cents per share on sales of $330-$340 million for the first quarter of 2015. Wall Street was expecting 17 cents a share ex items on $325 million in sales. The company also said Nina Richardson, its chief operating officer for the last two years was resigning.

GPRO recently lost $7.37 to $47.00. The stock is down more than 80% the past four months and 14% year-to-date.

GoPro, Inc. closed Thursday at $54.37. The name has a total market cap of $6.95B.

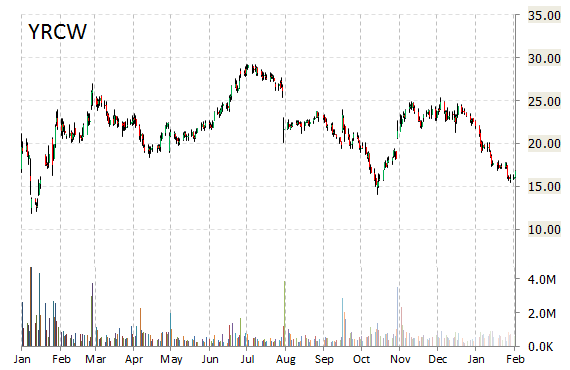

YRC Worldwide Inc. (YRCW) gained 13% to $20.17 in early trading on Friday after the company reported fourth-quarter profit of $6.2 million.

On an EPS basis, the Overland Park, Kansas-based company said it had profit of 16 cents. Wall Street was expecting a loss of 15 cents per share. Consolidated operating Q4’14 revs came in at $1.218 billion, a $10.0 million increase over the $1.208 billion reported yoy. At the same time, consolidated operating income increased $32.8 million, from an operating loss of $1.6 million, to operating income of $31.2 million.

YRC Worldwide Inc. currently valued at $560.13M, has a median Wall Street price target of $34.50. In the past 52 weeks, shares of Overland Park, Kansas-based transportation services provider have traded between a low of $14.03 and a high of $29.21 with the 50-day MA and 200-day MA located at $19.51 and $21.34 levels, respectively. Additionally, shares of YRCW trade at a P/E ratio of -0.89 and have a Relative Strength Index (RSI) and MACD indicator of 44.77 and +0.09, respectively.

YRC shares have declined 20.32% since the beginning of the year.

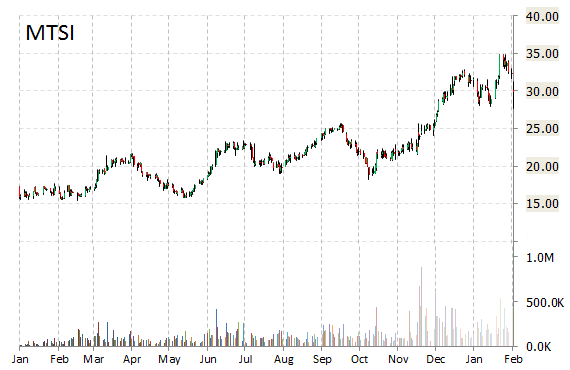

M/A-Com Technology Solutions Holdings, Inc. (MTSI) shares are up 4% to $31.83 in early trading, after announcing the pricing of its public offering of 7.8 million shares of common stock at $30.00 per share. The offering is expected to close on or about February 11.

Goldman (GS) and BofA (BAC) are acting as lead book-running managers for the offering.

On valuation measures, M/A-Com Technology shares have a PEG and forward P/E ratio of 0.90 and 14.50, respectively. Price/Sales for the same period is 3.25 while EPS is ($0.27). Currently there are 4 analysts that rate MTSI a ‘Buy’, 1 rates it a ‘Hold’. No analysts rate it a ‘Sell’. MTSI has a median Wall Street price target of $36.00 with a high target of $45.00.

Shares are up 96.15% year-over-year ; down 2.17% year-to-date.

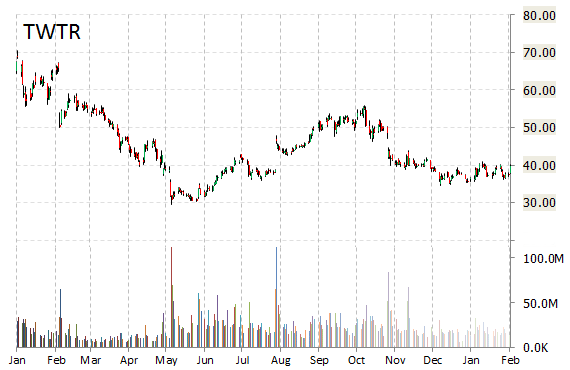

Twitter, Inc. (TWTR) is up nearly 14% to $46.81 this morning after reporting earnings Thursday night. The microblogging website operator crushed expectations with revs coming in at $479 million, up 97% yoy, beating expectations of $453.6 million by 6 percent. Adjusted EPS of 6 cents were double what Wall Street expected as well. The popular social network said user growth slowed in Q4 but has picked up once again in the new year. The company also confirmed reports that Twitter had struck a new deal with Google (GOOG) to include real-time tweets in the top-ranked search engine again.

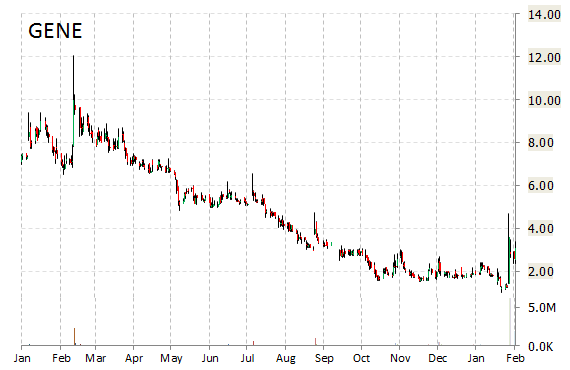

Genetic Technologies Limited (GENE) – JPMorgan (JPM) has disclosed a 7% stake in the company in a filing with the Australian Stock Exchange.

Genetic shares rose 7% to $4.00 at 10:02 a.m. in New York.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply