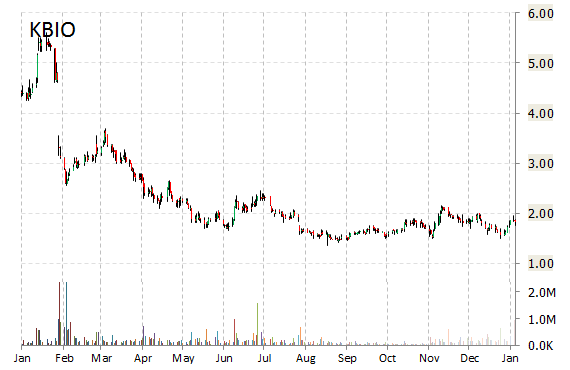

KaloBios Pharmaceuticals, Inc. (KBIO) is one of today’s notable stocks in decline, down as much as 67%. The nosedive comes after the company reported top-line data for Phase 2 Study of KB001-A to treat pseudomonas aeruginosa lung infections in cystic fibrosis patients. KaloBios said that while the data from this study showed KB001-A was generally safe and well-tolerated, the primary endpoint of increased time to need for antibiotics for worsening respiratory tract signs and symptoms was not met.

“The study did demonstrate a non-significant reduction in Pa titer in sputum measured post dosing and a 3% improvement in FEV1 (p=0.0029) at Week 16 for the KB001-A arm compared to placebo; however, these effects were not accompanied by improvements in other clinically significant end-points such as exacerbations or symptoms,” said Nestor A. Molfino, MD, MSc., KaloBios’ Chief Medical Officer.

Shares of KaloBios Pharmaceuticals lost $1.24 to $0.59 in recent trading. KBIO closed at $1.83 Tuesday.

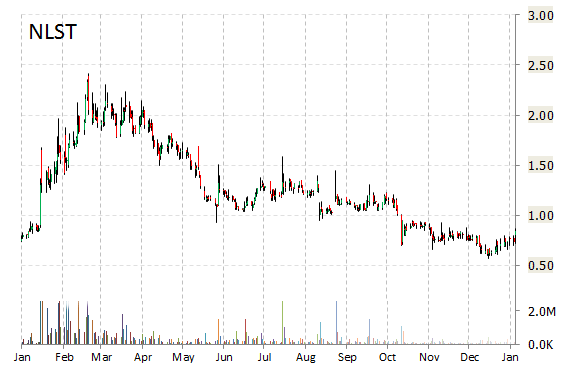

In a report published Wednesday, Needham analysts upgraded their rating on Netlist Inc. (NLST) from ‘Hold’ to ‘Buy’, and set the price target to $1.50. The equity research firm says they believe NLST appears to have won preliminary injunction on ULLtraDIMM.

NLST shares recently gained $0.22, or 24.93%, to $1.08. In the past 52 weeks, shares of Irvine, CA-based company have traded between a low of $0.57 and a high of $2.41. Shares are up 5.31% year-over-year.

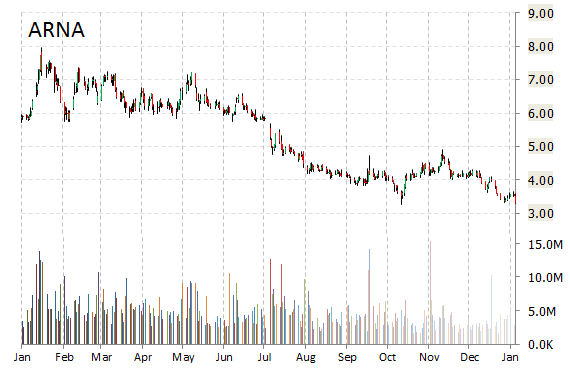

Arena Pharmaceuticals, Inc. (ARNA) today announced positive results from phase 1b clinical trial evaluating APD334 for the potential treatment of autoimmune diseases.

“Lymphocyte lowering at the level demonstrated in this trial has been shown to correlate with clinical efficacy in Phase 2 and Phase 3 trials of other S1P1 modulators in multiple sclerosis, psoriasis and ulcerative colitis,” said William R. Shanahan, M.D., Arena’s Senior VP and Chief Medical Officer.

ARNA shares recently gained $0.43, or 12.65%, to $3.76. The stock is down more than 43% year-over-year. In the past 52 weeks, shares of San Diego, California-based company have traded between a low of $3.26 and a high of $7.97.

Arena Pharmaceuticals has a total market cap of $826.53 million.

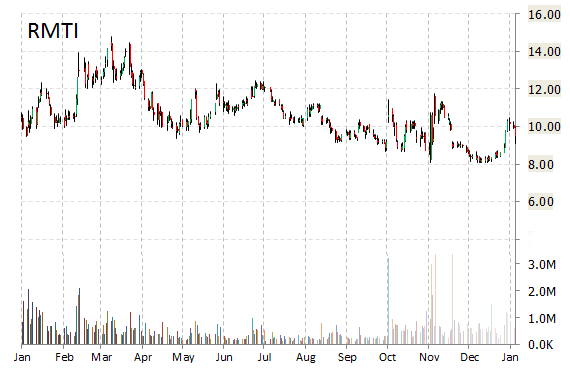

Investment analysts at Oppenheimer initiated coverage on shares of Rockwell Medical, Inc. (RMTI) in a note issued to investors on Wednesday. The firm set an ‘Outperform ’ rating and a $24 price target on the stock. Oppenheimer said they expect RMTI shares to have significant upside to be driven by the potential regulatory approval of Triferic, Rockwell’s lead investigational iron drug. The firm’s price target would suggest a potential upside of 138% from the stock’s current price of $10.05.

Rockwell Medical, Inc., currently valued at $441.18M, has a median Wall Street price target of $16.00 with a high target of $19.00. In the past 52 weeks, shares of integrated biopharmaceutical company have traded between a low of $8.10 and a high of $14.80 with the 50-day MA and 200-day MA located at $8.84 and $9.89 levels, respectively. Additionally, shares of RMTI trade at a P/E ratio of -0.72 and have a Relative Strength Index (RSI) and MACD indicator of 64.12 and +0.88, respectively.

RMTI currently prints a one year return of less than 1%. Ticker gained nearly 6% to $10.08 in recent trading.

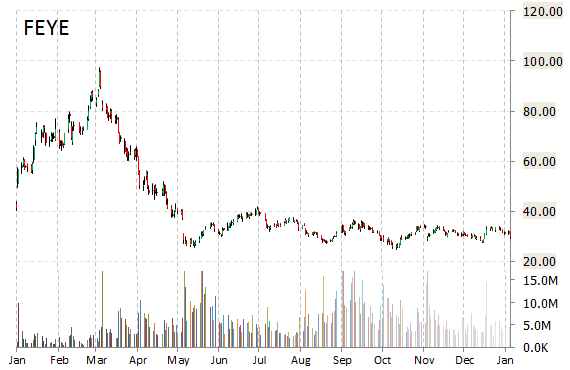

FireEye, Inc. (FEYE) stock price climbed Wednesday after BofA (BAC) named the cybersecurity solutions provider a “Top Security Pick” for 2015.

In other FireEye news this morning, the company announced an integration of the FireEye Threat Analytics Platform with NXLog. The integration enables security teams to feed NXLog network event log data into FireEye TAP and arm organizations with information needed to identify cyber attacks and investigate breaches.

Shares of the Milpitas, California-based company rose 4.23% to $31.13 in early trading after rising as high as $31.50 earlier in the session. FEYE has lost about 49% on a YoY basis.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply