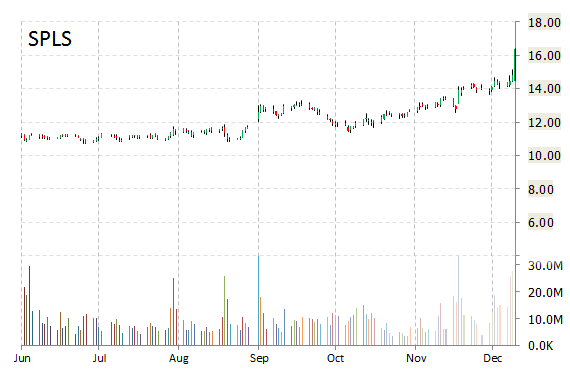

Shares of Staples, Inc. (SPLS) are up almost 11% to $16.35 in pre-market trading Thursday following a Wall Street Journal report that said activist investor Starboard Value took a 5.1% stake in the company, and boosted its position in Office Depot (ODP) to 9.9%, up from its prior 8.6% stake. Although Starboard said it does not have any present plan or proposal, the moves add to speculation about a potential push for M&A between the office supply retailers.

Staples, Inc., currently valued at $9.48B, has a median Wall Street price target of $13.00 with a high target of $15.00. In the past 52 weeks, shares of Framingham, Massachusetts-based company have traded between a low of $10.70 and a high of $16.04 with the 50-day MA and 200-day MA located at $13.41 and $12.07 levels, respectively. Additionally, shares of SPLS trade at a P/E ratio of -3.67 and have a Relative Strength Index (RSI) and MACD indicator of 71.21 and +0.32, respectively.

SPLS currently prints a one year loss of about 4.63% and a year-to-date loss of around 3.83%.

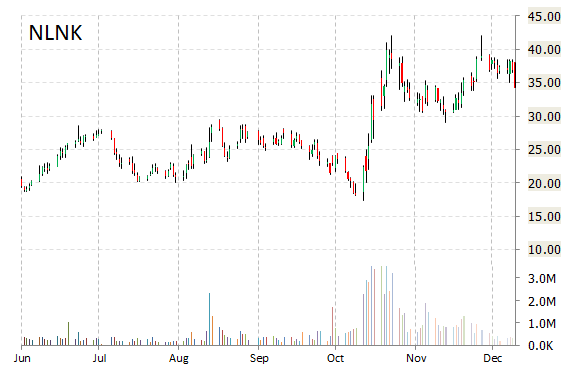

NewLink Genetics Corporation (NLNK) shares tumbled more than 7% to $34.27 in early trade Thursday, after a Reuters report stated a clinical trial of the Ebola vaccine by Merck (MRK) and NewLink has been interrupted “as a measure of precaution” after four patients exhibited joint pains in hands and feet.

NLNK currently prints a one year return of about 74.62% and a year-to-date return of 67.56%. Ticker has a market cap of $1.03 billion and a median Wall Street price target of $48.00 with a high target of $55.00.

The chart below shows where the equity has traded over the past 52-weeks

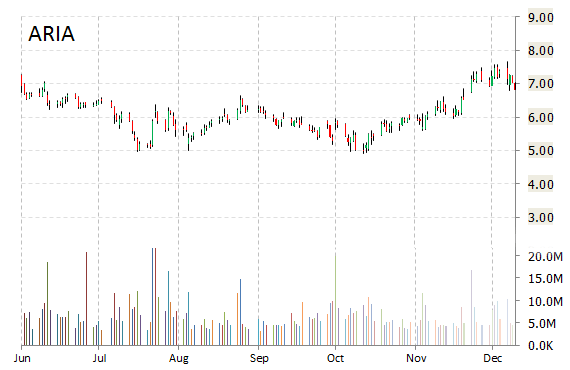

Shares of Ariad Pharmaceuticals Inc. (ARIA) are down nearly 3% in pre-market trade, after the company was downgraded to ‘Underperform’ from ‘Neutral’ by analysts at Credit Suisse (CS) this morning.

Analysts at the banking giant also lowered their 12-month base case estimate on the name to $6.50 from $8.00, saying *Iclusig launch metrics (*an oral drug developed by Ariad for the treatment of chronic myeloid leukemia [CML]) are weak and expects it to remain a last option for CML patients with specific resistant mutations or failure with other therapies.

Ariad Pharmaceuticals shares have gained 58.11% over the past 52 weeks, while the S&P 500 index has gained 14.12% in the same period.

Ariad’s shares dropped 20 cents to $6.85 in recent trading.

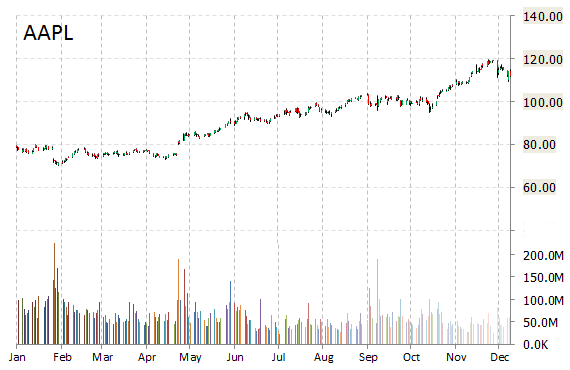

Apple (AAPL) shares edged higher in early trading on Thursday following reports that Apple Watch production may begin next month.

In other Apple news this morning, Cupertino announced that ‘iPad Air 2’ and ‘iPad mini 3’ with cellular networking will be available in China starting this week. Additionally, Business Insider reports United’s 23,000 flight attendants will get iPhone 6 Plus. United has been giving iPads to its pilots since 2011.

On valuation measures, Apple shares are currently priced at 17.36x this year’s forecasted earnings compared to the industry’s 25.81x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.26 and 13.09, respectively. Price/Sales for the same period is 3.59 while EPS is $6.45. Currently there are 33 analysts that rate AAPL a ‘Buy’, 11 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. AAPL has a median Wall Street price target of $122.00 with a high target of $150.00.

In the past 12 months, shares of the iPhone maker have traded between a low of $70.51 and a high of $119.75 and are now at $112.40. Shares are up 41.48% year-over-year and 2.63% year-to-date.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply