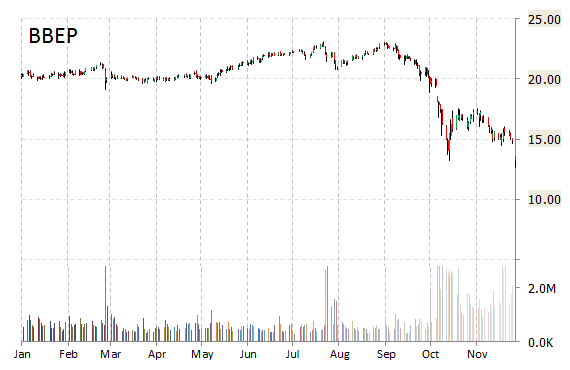

Breitburn Energy Partners L.P. (BBEP) is one of today’s notable stocks in decline, down as much as 16% to $11.11. The move comes on a big volume too with the issue currently trading more than 7.1 million shares, which dwarfs the average volume of 1.75 million. Not seeing any news or rumors to account for the move.

Breitburn Energy is a Los Angeles, Calif.-based independent oil and gas company. Its stock has a median consensus analyst price target of $20.50 with a high target of $25.00, and a 52-week trading range of $11.22 to $23.15.

The T-12 profit margin at Breitburn Energy Partners is (4.97%). BBEP‘s revenue for the same period is $857.08 million.

Breitburn Energy Partners L.P. has market cap of $1.57 billion.

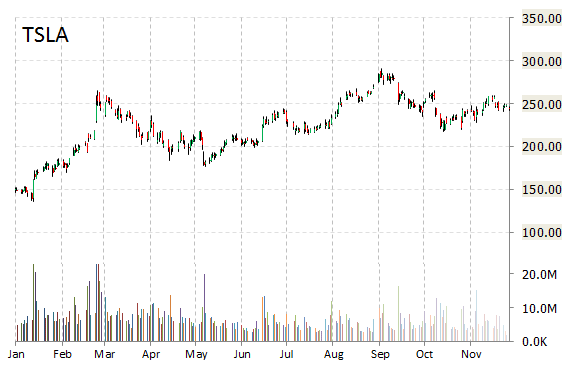

Shares of Tesla Motors (TSLA) are declining, lower by 5.38% to $230.64 in midday trading Monday after a German weekly reported Friday that BMW is not interested in acquiring a stake in the U.S. electric car maker.

The news comes after Tesla CEO Elon Musk told German news magazine Der Spiegel in an interview last week that his company was engaged in informal talks with BMW over a possible collaboration in batteries and charging-station technology.

On valuation measures, Tesla Motors shares have a PEG and forward P/E ratio of 4.96 and 80.02, respectively. Price/Sales for the same period is 10.73, while EPS is ($1.64). Currently there are 11 analysts that rate TSLA a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’. TSLA has a median Wall Street price target of $300.00 with a high target of $400.00.

In the past 52 weeks, shares of Palo Alto, Calif.-based company have traded between a low of $123.93 and a high of $291.42. Shares are up 92.63% year-over-year and 62.55% year-to-date.

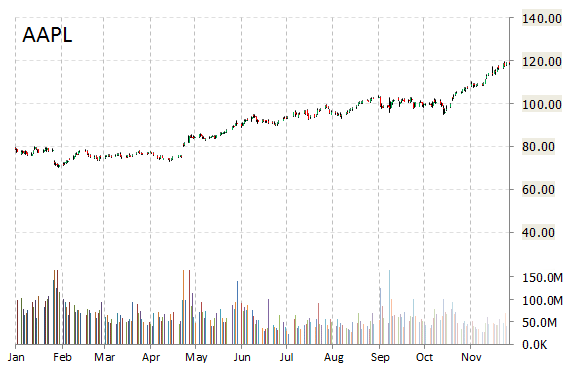

Apple Inc. (AAPL) shares tumbled nearly 4% to $115.03 in late trade Monday after Morgan Stanley (MS) trimmed its position in the company by 1 percent. The investment bank said its financial models have repeatedly recommended a modest reduction as the name consistently prints higher highs.

In other Apple news today, earlier in the session AAPL shares recorded their largest one-minute volume of trading since Oct. 29, plunging as much as 6.4% to $111.27 before rebounding.

Apple Inc., currently valued at $676.04B, has a median Wall Street price target of $120.00 with a high target of $150.00. Approximately 71M shares have already changed hands, compared to the stock’s average daily volume of 58.64M.

In the past 52 weeks, shares of the tech giant have traded between a low of $70.51 and a high of $119.75 with the 50-day MA and 200-day MA located at $108.36 and $98.83 levels, respectively. Additionally, shares of AAPL trade at a P/E ratio of 1.36 and have a Relative Strength Index (RSI) and MACD indicator of 62.07 and +2.65, respectively.

AAPL currently prints a one year return of about 55.69% and a year-to-date return of around 51.52%.

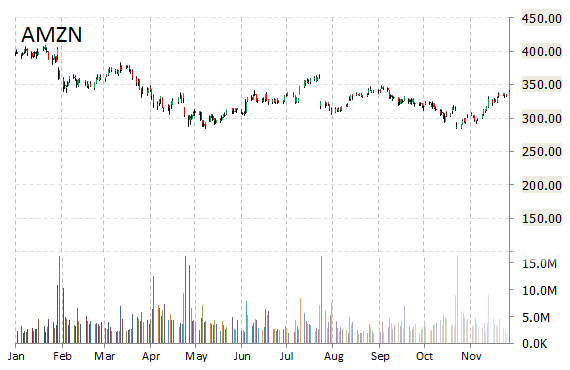

Amazon.com Inc. (AMZN) fell around 3.3% in late trading after Moody’s Investors Service (MCO) cut its outlook on the company from “stable” to “negative” while affirming its Baa1 senior unsecured debt rating.

Amazon shares recently lost $11.23 to $327.41. The stock is down more than 12.43% year-over-year and has lost roughly 15.08% year-to-date. In the past 12 months, shares of Seattle, Washington-based e-commerce giant have traded between a low of $284.00 and a high of $408.06.

Amazon.com has a current total market cap of $151.59B.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply