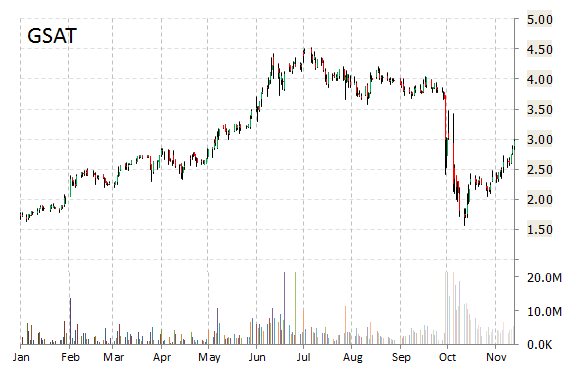

Shares of Globalstar Inc. (GSAT) are lower by 14% in pre-market trading Monday following Cramer’s unfavorable Friday mention at Mad Money Stocks. After analyzing the name’s performance, Jim recommended staying away from the name saying “Globalstar has become a total battleground”, and that there are easier ways to make money. Cramer added: “I am not the guy to settle battles about wireless technology, but I am concerned about Globalstar’s balance sheet.” The CNBC host was apparently referring to GSAT’s deteriorating net income, poor profit margins, and anemic EPS growth.

Globalstar Inc, currently valued at $2.94B, has a median Wall Street price target of $5.50 with a high target of $6. In the past 52 weeks, shares of Covington, Louisiana-based wireless communications company have traded between a low of $1.56 and a high of $4.53 with the 50-day MA and 200-day MA located at $2.49 and $3.46 levels, respectively. Additionally, shares of GSAT trade at a P/E ratio of -0.30 and have a Relative Strength Index (RSI) and MACD indicator of 63.56 and +0.35, respectively.

GSAT shares recently lost $0.37 to $2.60. The name prints a year-to-date return of around 70%.

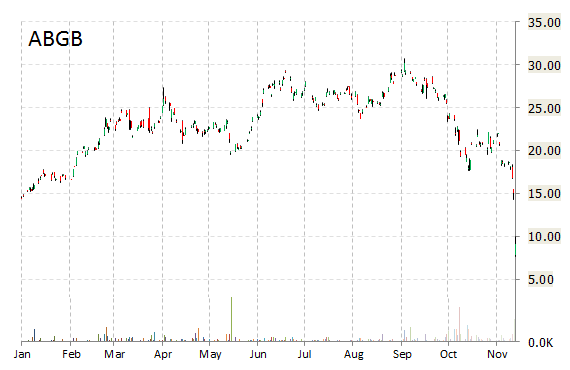

Abengoa SA (ABGB) is trading higher by nearly 19% pre-market. Not seeing any news or rumors to account for the move.

Abengoa is a Seville, Spain-based engineering and clean technology company. Its stock has a median consensus analyst price target of $28.72 with a high target of $44.00, and 52-week trading range of $7.71 to $30.75.

The T-12 profit margin at Abengoa SA is 1.69%. ABGB‘s revenue for the same period is $9.49B.

Abengoa SA has a market cap of $14.60B.

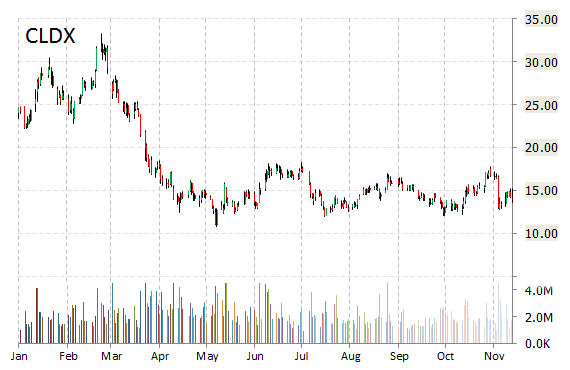

Shares of Celldex Therapeutics, Inc. (CLDX) are spiking 20% in pre-market trading Monday following a strong showing at the Society for Neuro-Oncology on Friday, and a price target raise to $43 per share at Roth Capital. The firm’s new PT represents expected upside of 136.50% from the stock’s current price-per-share.

Celldex Therapeutics recently gained $2.75 to $16.91.

On trading-measure, CLDX has a beta of 3.48 and a short float of 22.45%. In the past 52 weeks, shares of Hampton, New Jersey-based biopharmaceutical company have traded between a low of $10.76 and a high of $33.33 with the 50-day MA and 200-day MA located at $14.49 and $14.67 levels, respectively. Celldex has a market cap of $1.27B and a median Wall Street price target of $33.00 with a high target of $45.00.

The name currently prints a one year loss of about 43.06%, and a year-to-date loss of around 41.51%.

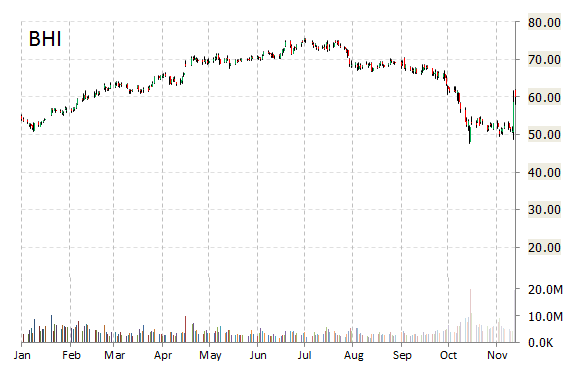

Baker Hughes Incorporated (BHI) – The oilfield services company shares are higher 13.47% after announcing it will be bought by rival Halliburton (HAL) for $34.6 billion, or for $78.62 a share, representing a 40.8% premium to BHI’s pps on October 10. BHI holders will receive a fixed exchange ratio of 1.12 Halliburton shares plus $19 for each share they now hold.

On valuation measures, Baker Hughes shares are currently priced at 20.25x this year’s forecasted earnings compared to the industry’s 15.70x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.52 and 12.37, respectively. Price/Sales for the same period is 1.09, while EPS is $2.96.

Shares are up 3.85% year-over-year ; up 9.53% year-to-date.

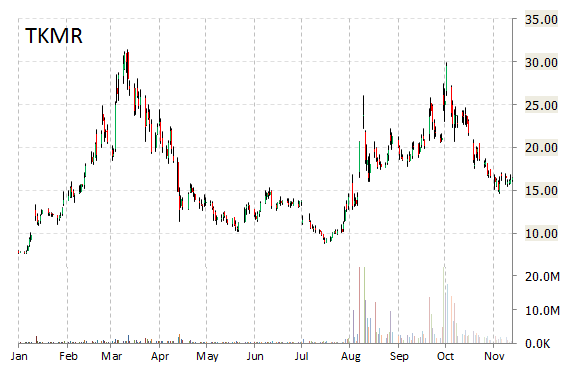

Shares of Tekmira Pharmaceuticals Corp (TKMR) are up almost 4% to $17 in pre-market after the company announced a licensing and collaboration agreement with Dicerna Pharmaceuticals, Inc. (DRNA). TKMR has licensed its proprietary lipid nanoparticle delivery technology for exclusive use in DRNA’s primary hyperoxaluria type 1 (PH1) development program.

Under the agreement, Dicerna will pay Tekmira $2.5 million upfront and payments of $22 million in aggregate development milestones, plus a mid-single-digit royalty on future PH1 sales. This new partnership also includes a supply agreement with Tekmira providing clinical drug supply and regulatory support in the rapid advancement of the product candidate.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply