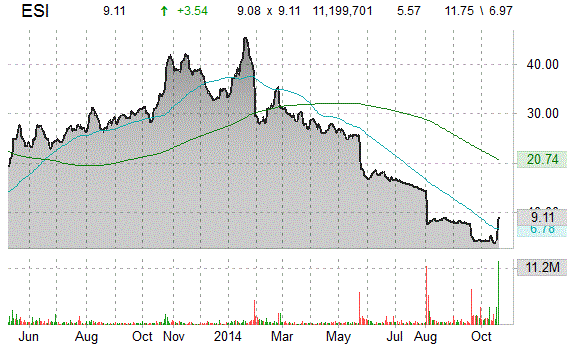

The stock of ITT Educational Services Inc. (ESI) is having a great day, blasting up more than 72% after the provider of post-secondary degree programs in the U.S. said it enrolled more students than it forecast in the quarter ended June 30. ITT said new student enrollments are expected to have fallen 8.1% in 2Q, less than the 10-15% it forecast in May.

ESI shares recently gained $4.14 to $9.71. In the past 52 weeks, shares of Carmel, Indiana-based firm have traded between a low of $3.66 and a high of $45.80.

ITT Educational Services, which closed Thursday at $5.57, has a total market cap of $226.92M.

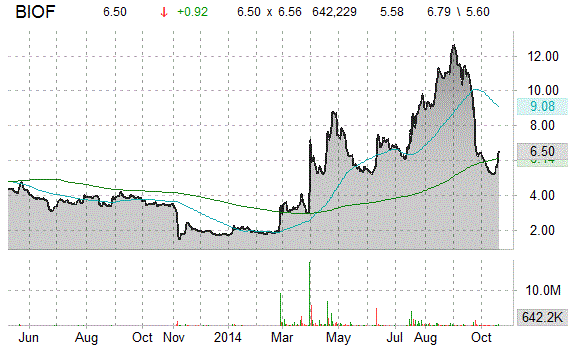

BioFuel Energy Corp. (BIOF) is a big mover this session with its shares spiking nearly 18% on the day. Approximately 642,279 shares have already changed hands, compared to the stock’s average daily volume of 747,043 shares.

BIOF shares recently gained $0.98 to $6.56. The stock is up more than 144.74% year-over-year and has gained roughly 398.21% year-to-date. In the past 52 weeks, shares of Denver, Colorado-based company have traded between a low of $0.74 and a high of $8.56.

BioFuel Energy Corp., which closed Thursday at $5.58, has a total market cap of $35.78M.

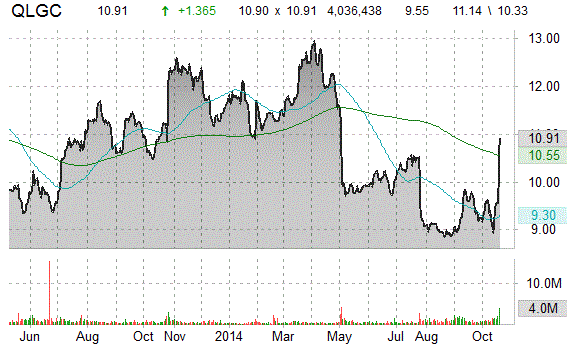

QLogic Corp. (QLGC) shares are currently printing a large uptick, gaining more than 14% from the previous close after the company reported $0.25 EPS for 2Q’15, beating the analysts’ consensus estimate of $0.22 by $0.03. QLogic said net revenue for the second quarter was $127.5M and increased 13% from $112.6M in the same quarter last year.

In other QLogic news; the company announced approval of $100M stock repurchase program.

QLogic Corp. gained $1.35 to $10.89 in mid-day trading today. Approximately 4,204,483 shares have already changed hands, compared to the stock’s average daily volume of 1,115,140 shares.

On valuation-measures, shares of QLogic Corp. have a forward P/E of 11.12. P/E to growth ratio is 0.49, while t-12 profit margin is (1.97%). EPS registers at ($0.11). The company has a market cap of $956.35M and a median Wall Street price target of $11.00 with a high target of $13.00.

On trading-measure, QLGC has a beta of 1.72 and a short float of 4.02%. In the past 52 weeks, shares of the server and storage networking infrastructure products provider have traded between a low of $8.70 and a high of $13.07 with the 50-day MA and 200-day MA located at $12.28 and $11.78 levels, respectively.

QLGC currently prints a one year loss of about 13% and a year-to-date loss of around 19.27%.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply