Recent short interest data for the 9/30/2014 settlement date shows a spike in short interest for shares of DryShips, Inc. (DRYS). As of September 30, the short interest for the owner of dry bulk carriers totaled 13,002,462 shares, as compared to 7,057,968 shares since September 15, a jump of 84.22%. Average daily volume [AVM] for the same period rose by 3,415,348 to 7,805,561 shares from 4,390,213 shares. It is worth mentioning that ticker’s short interest has jumped by more than 6.86M shares, or 112%, from the 8/29/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.67 days. Days-to-cover for DRYS increased to 1.67 for the September 30 settlement date, as compared to 1.61 days at the September 15 report.

On valuation measures, DRYS, currently valued at $827.64M, has a median Wall Street price target of $3.00 with a high target of $5.00. Approximately 6,863,775 shares have already changed hands, compared to the stock’s average daily volume of 5,847,660.

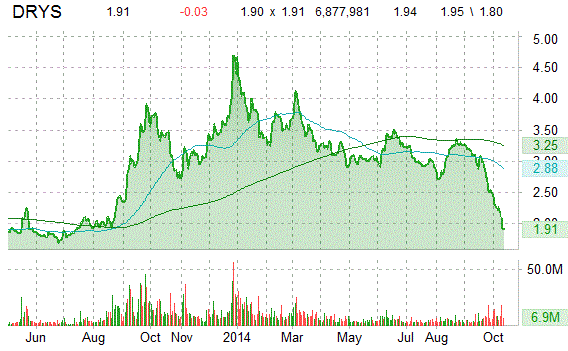

In the past 52 weeks, shares of Athens, Greece-based company have traded between a low of $1.80 and a high of $5.00 with the 50-day MA and 200-day MA located at $2.86 and $3.05 levels, respectively. Additionally, shares of DRYS trade at a P/E ratio of 9.70 and have a Relative Strength Index (RSI) and MACD indicator of 17.45 and -0.34, respectively.

On trading measures, DryShips has a beta of 3.34 and a short float of 3.49%.

DRYS recently traded at $1.90, down 1.80%. Shares are down 41.39% year-over-year, and 58.72% year-to-date.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply