GT Advanced Technologies Inc. (GTAT) is trading at an unusually high volume Monday with 112,139,801 million shares changing hands. It is currently at more than 10x its 3-month average volume.

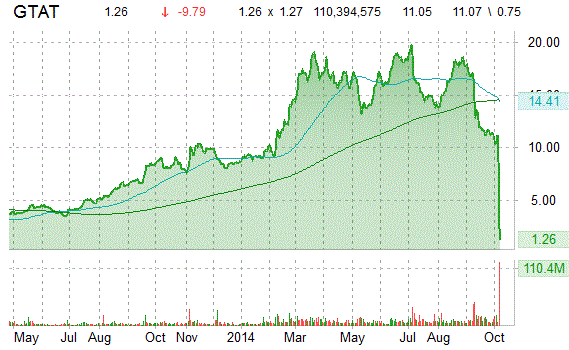

GTAT, the maker of sapphire display covers for Apple (AAPL)’s upcoming smartwatch, dipped nearly 10 points, or 88%, in early trading after the company announced that it had filed for bankruptcy court protection under Chapter 11. In a press release , GT said it expects to conduct business as usual while it works to resolve its current issues and develops a reorganization plan.

“GT has a strong and fundamentally sound underlying business,” GT CEO Tom Gutierrez said in a statement. “Today’s filing does not mean we are going out of business; rather, it provides us with the opportunity to continue to execute our business plan on a stronger footing, maintain operations of our diversified business, and improve our balance sheet.”

On valuation-measures, shares of GT Advanced Technologies have a forward P/E of 2.55. P/E to growth ratio is (9.12), while T-12 profit margin is (132.91%). EPS registers at ($1.56). The company has a market cap of $184.30M and prior to today’s nosedive had a median Wall Street price target of $15.00 with a high target of $20.00.

On trading-measure, GTAT has a beta of 3.28 and a short float of 40.80%. In the past 52 weeks, shares of Merrimack, New Hampshire-based tech company have traded between a low of $0.75 and a high of $20.54 with the 50-day MA and 200-day MA located at $14.53 and $15.89 levels, respectively.

GTAT currently prints a one year loss of about 88%.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply