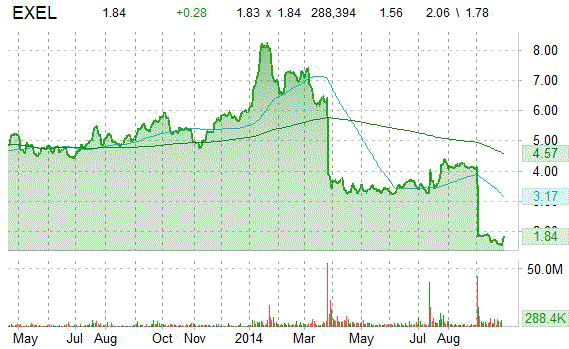

Shares of Exelixis, Inc. (EXEL) are up almost 23% to $1.91 in pre-market trading Monday after the company announced positive results from coBRIM, the phase 3 pivotal trial of cobimetinib, a specific MEK inhibitor discovered by Exelixis, in combination with vemurafenib in previously untreated patients with BRAF V600 Mutation-positive advanced melanoma.

Exelixis, Inc. shares have a PEG and and price-to-sales ratio 0.05 and 14.21, respectively. EPS is ($1.52). Currently there is only 1 analyst that rates EXEL a ‘Strong Buy’, 1 rates it a ‘Buy’ and 6 rate it a ‘Hold’. No analysts rate it a ‘Sell’. EXEL has a median Wall Street price target of $2.50 with a high target of $5.00.

In the past 52 weeks, shares of South San Francisco, California-based company have traded between a low of $1.51 and a high of $8.41. Shares are down 73.06% year-over-year, and 74.55% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

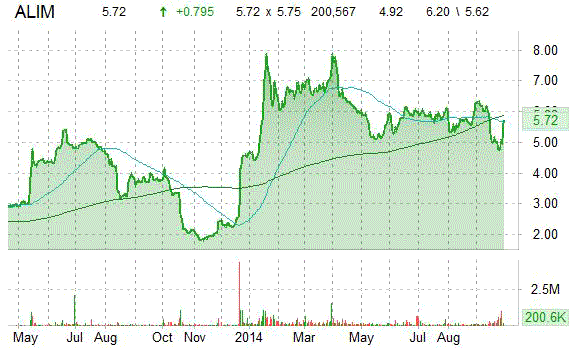

Alimera Sciences Inc. (ALIM) is a big mover this pre-market session, as its shares are up nearly 20%. The surge came after the pharmaceutical company announced that it will hold a conference call to provide additional information regarding the recent approval by the U.S. Food and Drug Administration [FDA] of ILUVIEN® for the treatment of diabetic macular edema. ILUVIEN was approved without any restriction requiring patients to have undergone, or be scheduled for, cataract surgery.

Alimera Sciences, currently valued at $199.09M, has a median Wall Street price target of $7.00 with a high target of $7.00. In the past 52 weeks, shares of the clinical-stage biopharmaceutical company have traded between a low of $1.65 and a high of $8.44 with the 50-day MA and 200-day MA located at $5.64 and $5.93 levels, respectively. Additionally, shares of ALIM trade at a price/sale ratio of 34.75 and have a Relative Strength Index (RSI) and MACD indicator of 37.93 and -0.39, respectively.

ALIM currently prints a one year return of about 29.74% and a year-to-date return of around 4.90%. Shares are trading up 75 cents, or 15.74%, at $5.70 as of 8:09 a.m. ET.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

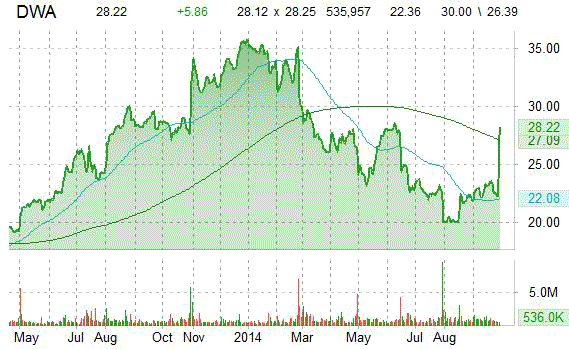

Shares of Dreamworks Animation (DWA) are up 27.50% to $28.51 in pre-market trading Monday after the company was reported to be in merger talks with Tokyo-based wireless carrier SoftBank Corp. (SFTBY). According to The Hollywood Reporter, SoftBank is said to have offered $32/share for the studio’s stock, which is a 30% premium over its Friday closing PPS of $22.36.

DreamWorks Animation, currently valued at $1.89B, has a median Wall Street price target of $22.00 with a high target of $27.00. In the past 52 weeks, shares of Glendale, California-based animation studio have traded between a low of $19.20 and a high of $36.01 with the 50-day MA and 200-day MA located at $22.17 and $24.44 levels, respectively. Additionally, shares of DWA trade at a P/E ratio of -29.64 and have a Relative Strength Index (RSI) and MACD indicator of 49.97 and -0.45, respectively.

DWA currently prints a one year loss of about 22.12% and a year-to-date loss of around 37.00%.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply