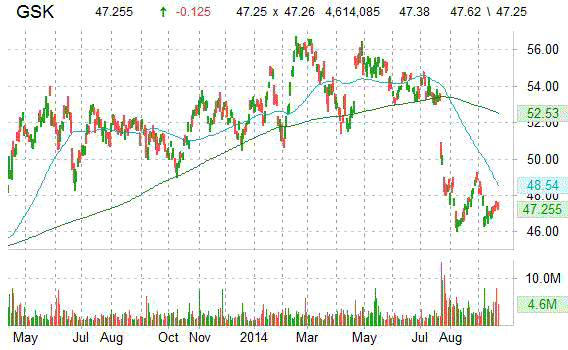

Drug maker GlaxoSmithKline plc (GSK) had its rating upgraded to ‘Buy’ from ‘Neutral’ by analysts at Goldman Sachs (GS) on Monday.

GSK shares recently gained $0.20 to $47.58. In the past 52 weeks, shares of Brentford, the United Kingdom-based pharmaceutical company have traded between a low of $46.01 and a high of $56.73. Shares are down 5.82% year-over-year and 10.82% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

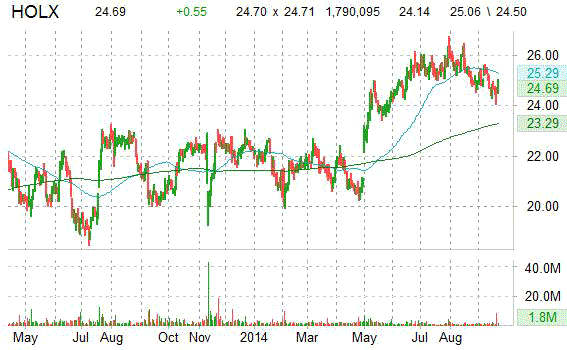

Hologic, Inc. (HOLX) was raised to ‘Overweight’ from ‘Neutral’ and it was given a $32 from $28 price target at Piper Jaffray on Monday. The prior close was $24.14. The firm’s new PT represents expected upside of 32.56% from the stock’s current price-per-share

Hologic Inc. is priced at 16.14x next year’s forecasted earnings. Ticker has a PEG and price-to-sales ratio of 2.15 and 2.71, respectively. EPS is ($4.22). Currently, HOLX has a median Wall Street price target of $28.00 with a high target of $31.00.

In the past 52 weeks, shares of Bedford, Massachusett-based company have traded between a low of $19.25 and a high of $26.75 and are now at $24.65. Shares are up 22.82% year-over-year and 10.78% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

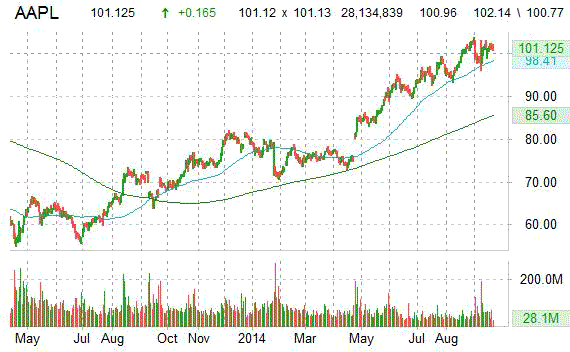

Apple (AAPL) was given a $130 from $115 price target at Global Equities Research on Monday. The firm’s new PT implies 28.81% expected return from ticker’s current $100.92 pps.

Separately, Piper Jaffray analysts said in a research report this morning they believe Apple’s revenue could top expectations by 9% and its EPS by nearly 12% in the December quarter. The asset management firm kept an ‘Overweight’ rating on the stock with a $120 price target.

Apple Inc. shares are currently priced at 16.96x this year’s forecasted earnings compared to the industry’s 23.64x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.31 and 14.15, respectively. Price/Sales for the same period is 3.39 while EPS is $5.96. Currently, AAPL has a median Wall Street price target of $110.00 with a high target of $139.00.

In the past 52 weeks, shares of Cupertino, California-based company have traded between a low of $67.77 and a high of $103.74. Shares are up 51.76% year-over-year and 26.42% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply