Shares of Apple (AAPL) fell more than 1 percent to $524.75 at the close today in New York and have risen $44, or 8.35%, in after-market trading Wednesday, after the iPhone maker reported results for its fiscal 2014 second quarter ended March 29, 2014.

The company reported $11.62 earnings per share for the quarter, up from $10.09 a year ago. The consensus estimate was for EPS of $10.19.

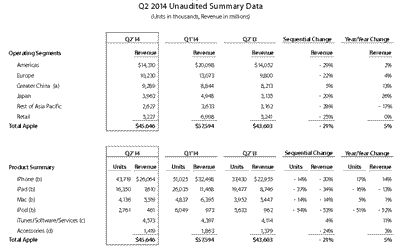

Revenue in the three months ended in March jumped to $45.6 billion, compared to the consensus estimate of $43.67 billion. Apple sales were higher than the $43.6 billion the company reported in last year’s fiscal second quarter. iPhone sales came in at 44 million units crushing expectations; sales of the iPad however, came up short.

Gross margin was 39.3% vs 37.5% in the year-ago quarter. International sales accounted for 66% of the quarter’s revenue.

“We’re very proud of our quarterly results, especially our strong iPhone sales and record revenue from services,” Tim Cook, Apple’s CEO, said in a statement. “We’re eagerly looking forward to introducing more new products and services that only Apple could bring to market.”

“We generated $13.5 billion in cash flow from operations and returned almost $21 billion in cash to shareholders through dividends and share repurchases during the March quarter,” said Peter Oppenheimer, Apple’s CFO. “That brings cumulative payments under our capital return program to $66 billion.”

Apple is providing the following guidance for its fiscal 2014 third quarter:

• revenue between $36 billion and $38 billion

• gross margin between 37 percent and 38 percent

• operating expenses between $4.4 billion and $4.5 billion

• other income/(expense) of $200 million

• tax rate of 26.1 percent

(click to enlarge)

Apple also authorized a 7-for-1 stock split, which means that shareholders will receive six additional shares of Apple stock for every share they now own. The split will go into effect on June 2nd this year. The company also said it would increase its share buyback program to more than $130 billion by the end of 2015, up from its previous $100 billion plan.

Billionaire investor Carl Icahn took to Twitter (TWTR) to express his satisfaction regarding Apple’s buyback and earnings results saying “Agree completely with $AAPL’s increased buyback and extremely pleased with results. Believe we’ll also be happy when we see new products.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply