While Francis Galton may have found that crowds are a surprisingly accurate forecaster of things like ox weights, when it comes to modern finance it doesn’t appear as if the crowd of MM readers carry any more wisdom (or at least conviction) than he himself does.

Indeed, while the participation was gratifying and there was a, ahem, lively debate in the comments section between the deflation and inflation camps, the results of the polls were depressingly close to Macro Man’s own, uninspired views. The results were as follows:

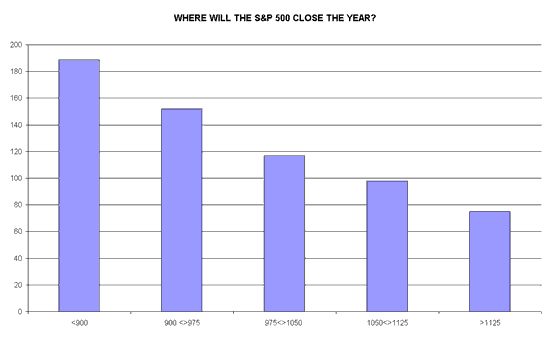

SPX: Readers are, on balance, bearish, with a sequential decline in votes for successively higher price buckets. That’s probably an accurate reflection of the global macro consensus, which suggests that Macro Man isn’t alone in his bemusement over the apparently bullet-proof rally in equities from the July lows.

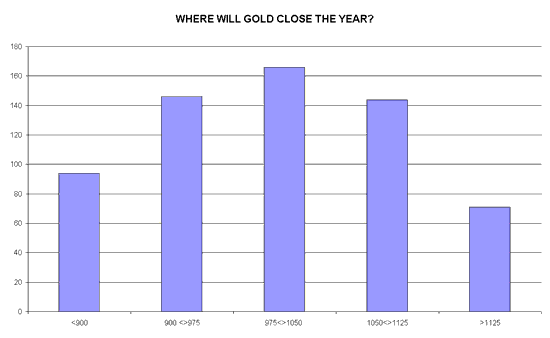

Gold: The responses for gold were almost perfectly balanced, with the plurality of the vote looking for prices broadly around current levels. Indeed, the outcomes between 900 and 1125 are almost perfectly balanced. Somewhat surprisingly (to Macro Man, at least), tail risk looks moderately skewed towards lower, rather than higher, prices. Does this perhaps say something about the degree to which deflationists modestly outnumber inflationists?

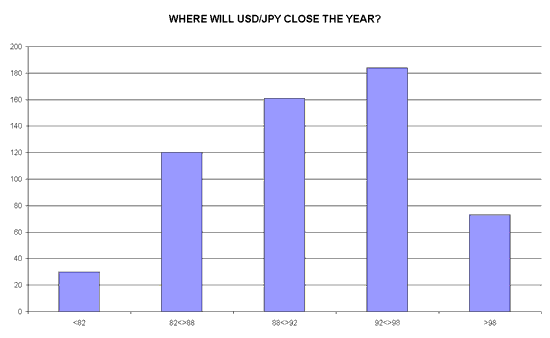

USD/JPY: Macro Man has avoided the yen for the past several months as part of his general boycott of G10 FX. It’s a decision that served him well, as he probably would have been tempted to buy the dip at some point. It looks like he would have had company, as the most popular choice called for a rebound between 92 and 98. Similarly, upside tail risk was given a much higher probability than downside tail risk. Macro Man isn’t sure what to make of it, but it does seem tempting to buy some low delta yen calls….

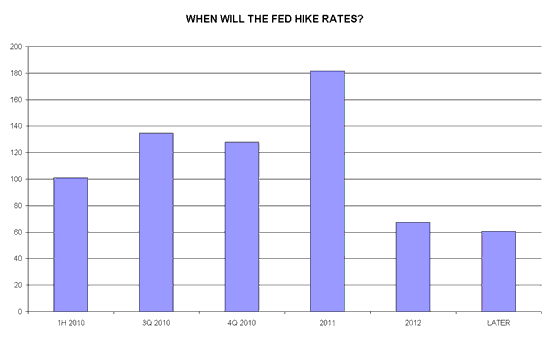

Fed: Although 2011 won the plurality of the votes here, a slim majority of resp0ndents (54%) believe that the Fed will hike rates at some point next year. Macro Man was slightly surprised to see that nearly a fifth of readers don’t expect a rate hike ’til 2012 or later…presumably they were among those who voted for lower equities and lower gold. At some point, Macro Man might get lured back into bearish trades in the reds or even the greens….

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply