After remaining nearly empty for years, the initial public offerings calendar is coming back to life this year.

Unfortunately for eager investors, most of these new stocks are succumbing to lower prices as spooked traders bail on the once-popular momentum stocks of 2013…

But that won’t stop the flow of new IPOs. Not yet, at least. So far this month, we’ve already seen 23 new names hit the open market. Three more are scheduled to IPO sometime today.

I’m not going to sit here and pretend to know everything (or anything at all) about most of these companies. A few names have looked familiar, like GubHub Inc. (NYSE:GRUB), a company that helps you stuff your face with its mobile restaurant take-out and delivery platform. But for the most part, the names are unfamiliar. They’re showing up to bank some easy cash and line the pockets of underwriters.

However, excited investors haven’t been so lucky…

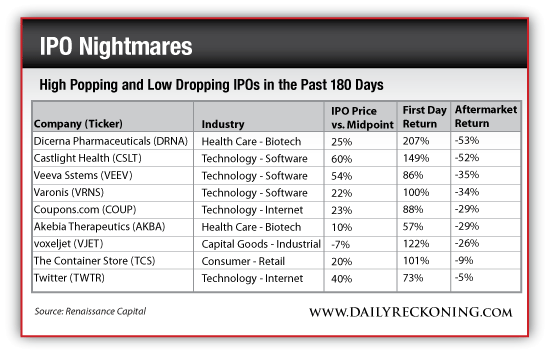

“As the NASDAQ experienced its biggest one-day drop since late 2011 amid a continued tech sell-off, the biggest losers have been companies that saw spectacular first-day trading,” reports Renaissance Capital. “The market’s downturn is a response to some speculative buying of these as-of-yet unprofitable companies.”

The stats are damning. The top two first-day performers in the past year have also been two of the worst in aftermarket trading, according to Renaissance. Also, more than half of all IPOs in 2014 have dropped in the aftermarket.

But hey, you’re not supposed to make money on IPOs. That’s just not how it works. While they might look tempting in a red-hot market, now’s not the time to jump on every new issue with a cool ticker.

As a rule, you should avoid any longer-term trade in newly listed stocks. Let them get some price action under their respective belts before planning a buy. And now that the “growth” neighborhood is under siege, you should consider looking elsewhere for new trades.

That’s why I’m turning to a sector poised to post new highs very soon.

Leave a Reply