It is difficult to believe but its been only just over three months since Twitter (TWTR) went public, opening at $46/share and then continuing its climb into the stratosphere, in the weeks following. As many of you who read my posts know, my assessment of Twitter’s value, prior to the IPO, was about $18/share and I believed then that the $26/share at which the company was priced was a reach. Clearly, the market believes otherwise.

Last week did see a setback, though it may be temporary, in Twitter’s climb. It came in the form on an earnings report that on its face, at least, looked like it contained good news. The company reported revenues that beat expectations and claimed to have turned the corner on profitability, at least using its own adjusted version of earnings, with positive earnings per share for the quarter. The market, though, reacted negatively, wiping out 25% of Twitter’s market value in the course of a few minutes. Note, though, that even after this drop, Twitter’s stock price is at $53, well above my target range for its value. In this post, I would like to first look at the news in the earnings report, and then update my valuation to reflect Twitter’s first quarterly earnings report and see if value (or at least my assessment of it) has shifted. I would like to follow up with an examination of why the market price may have reacted the way it did to the information in the report.

Twitter’s Quarterly Earnings: Reading the tea leaves

With young companies like Twitter, a quarterly report can sometimes lead to large reassessments of value. Rather than prejudge the market reaction, it is worth breaking down the report into its component news items. Let’s start with the good news:

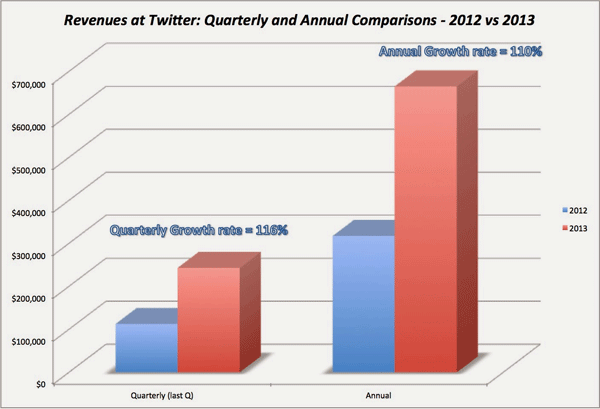

- Revenue growth in the fourth quarter was strong: Revenues more than doubled (increasing 116%) in the last quarter of 2013 (relative to the same quarter in 2012) and annual revenues in 2013 also increased by 110% over the revenues in 2012. Both numbers beat analyst expectations.

- While the company’s reported operating losses surged in the fourth quarter, a significant portion of its expenses were associated with R&D and employee compensation: Expenses are expenses, but these two items may be less onerous for two reasons. One is that R&D represents investment for future growth, which is where investors see Twitter’s value coming from. The other, and shakier assumption, is that these expenses will become smaller, if not in dollar terms but at least in percentage terms, as revenues get larger.

- Advertising is working and there is room to grow: The ad revenue per thousand timeline views grew to $1.49 in the fourth quarter, from a little less than a dollar per thousand views, just a quarter ago and this the driver for the revenue growth. The company also noted that its sponsored tweets are a small percentage of the overall content and that there is little danger of them overwhelming the content (and driving away users), at least for the moment.

There were some sour notes in the report as well:

- User growth is slowing and Twitter is having to work harder to add users: While the number of users reached 241 million, that was a growth of only 4% over the number last quarter, suggesting that growth is slowing. There is also some evidence that Twitter now has to work harder to acquire new users and that the growth is not effortless like it was earlier in their life. Finally, this article in the Wall Street Journal suggests a lagging in user engagement, and there is evidence of a decline in timeline views by users.

- International revenue growth is still lagging: While Twitter’s user base internationally is substantial, the proportion of it revenues that come from these users is small. For whatever reason, Twitter’s online advertising seems to not be as productive outside the US. To the extent that the potential user base is far greater in the rest of the world, this has to be remedied if Twitter wants its revenue growth to continue.

- The competition is not staying still: The good news about online advertising during the last few months was not restricted to Twitter. Facebook (FB) also reported that its online advertising revenues were up, as did Google (GOOG). To the extent that these and other companies are eventually going to be fighting over a relatively static pie, it is clear that there will be winners and losers.

More generally, the IPO and the months since have brought more general good news for the company, at least on two fronts:

- The IPO went smoothly: While this may seem trivial, remember that Facebook spent its first six months as a public company, digging itself out of a hole, because of its botched public offering. Twitter’s IPO hit all the right notes, at least from a marketing standpoint, easing the process for the company to focus on operations and growth.

- Corporate governance is not awful: While this is damning with faint praise, Twitter is a corporate governance standout among social media companies. Unlike its peer group, where founders have consolidated control by issuing shares with lower voting rights to the public, Twitter has only one class of shares. The benefits of that may not be visible right now but they will be when times become tougher.

- Online advertising, as a business, is booming: It always helps to be in a growing market and digital advertising is clearly catching on, often at the expense of print and other media advertising. A rising tide lifts all boats and in this case, you see the benefits play out across all of the social media companies that are dependent on advertising.

Overall, my assessment of the earnings report was that it did not contain surprising news and that the news that it did contain affirmed the difficulties of scaling up. Twitter is a small company, when it comes to revenues, and it was able to grow at a prodigious rate. It is, however, a large company when it comes to its user base and growth was slower.

Twitter Valuation: Then and Now

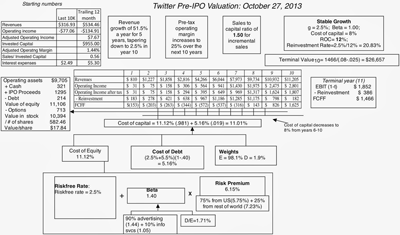

I went back to October 27, 2013, when I did my pre-IPO valuation of Twitter. Rather than reproduce the entire valuation, I have the picture of the valuation below:

(click to enlarge)

My assessments of the overall value of equity of $11.1 billion and the value per share of $17.84 are driven by two key assumptions: that revenues will grow over the next decade to $11.2 billion and that operating margins will improve over time to 25%. You can download the spreadsheet by clicking here.

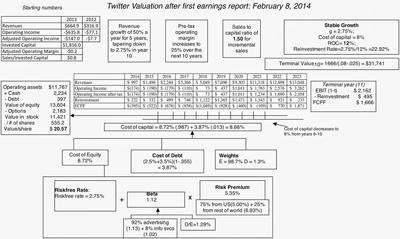

Given the earnings report and the other developments since the IPO, I revisited my assumptions.

- Revenue growth: The revenue growth in the fourth quarter, the guidance provided by the company and the growth of the overall online advertising market led me to become more optimistic in my revenue growth assumptions. I revised my target revenues in 2023 to be $13.05 billion. (Note that I assumed a growth rate of 50% a year for the first 5 years, which will lead me to understate revenue growth in the near years and overstate it later. For instance, the guidance for revenue growth in FY 2014 is that it will be 77%. The net effect of my smoothing assumption on value is small (a few cents).)

- Target margin: While my target margin stayed at 25%, my margins in the earlier years are now much more negative. The quarterly report suggests to me that revenue growth is going to cost more than I had initial assumed and that the company will continue to report operating losses for the near term. As for the company’s claim that it made money in the fourth quarter, I don’t buy this fiction.

- Reinvestment: The number that drives reinvestment in the valuation is the ratio of revenues to capital. While I assume that this ratio will be 1.50 ($1.5 in additional revenue for each dollar of capital), Twitter has gone backwards on this measure in the last quarterly report. The sales to capital ratio for the company has dropped from 1.10 to 0.80, a decline I am attributing to acquisitions and investments that will pay off in the future. (Remember that a higher number for the sales to capital ratio will reduce reinvestment and increase cash flows/value).

- Discount rate: Though it’s been only three months since the IPO valuation, the macro numbers have changed as well. The US treasury bond rate, which was at 2.5% on October 27, 2013, has increased to 2.75% today (February 11, 2014). The equity risk premium for the S&P 500 has dropped from 5.8% in October 2013 to about 5% in January 2014, and bringing down the equity risk premium used for Twitter (reflecting its international sales) to 5.34% from 6.15% in October 2013. Updating my beta measures (to reflect my 2014 estimates of risk in advertising and information services) lowers the beta for Twitter to 8.66%, a fairly substantial drop from the 11.04% in the IPO valuation.

Adjusting the number of shares outstanding to 555.2 million, to reflect adjustments after the IPO, we arrive at the following:

(click to enlarge)

The updated equity value of $13.6 billion is about 23% higher than the value in the IPO valuation but the value per share of $20.57 is only 15% higher than the estimated value per share of $17.84 in the IPO valuation. One reason is that the options outstanding in the company, with an average exercise price of $1.84, are now worth a great deal more at today’s stock price, representing a drain in value to common stockholders. You can download the spreadsheet by clicking here. As always, these are just my estimates and yours may be very different. You are welcome to change the numbers in the valuation and come up with your own conclusions. Once you have done so, please enter your numbers in this shared Google spreadsheet.

Revisiting the Earnings Report

There are paradoxes aplenty in the pricing and valuation of Twitter and I will not even claim to be able to understand, let alone explain them. However, I will draw on a device that I have used before and find useful to explain how markets move, which is the distinction I make between value and price. The successful IPO and the price run-up in the weeks after has made Twitter into a pricers’ game, where it is mood and momentum that determines price movements, not fundamentals. The nature of this game is that it can shift unpredictably and in response to incremental or even trivial news stories. Did Twitter deserve to lose 25% of its value because its user base did not grow as strongly as expected? Perhaps not, but did it deserve to double in value in the weeks before on the basis of no real information that would lead to reassess its future as a company? I don’t think so! If you are playing the pricing game, it is best not to try to explain (as many were trying to do last week) what happens to the price, using fundamentals.

Am I predicting that Twitter’s stock price will drop back into the twenties? Of course, not, but I would not be surprised if it did, and if the drop was triggered by another piece of trivial news or even non-news. At the same time, I would not be surprised to see the stock double to $100/share, triggered by a different news story. I have used this analogy before but there is no harm in using it again. When uncertainty about the future is high, markets (and investors) become bipolar and predicting their behavior is a fool’s game.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply