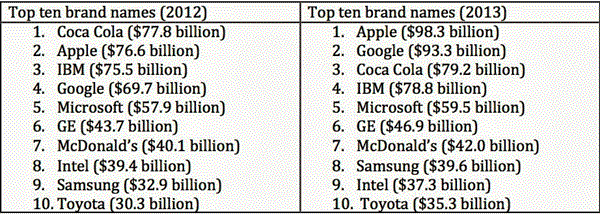

The Interbrand rankings of the top brand names in the world are out. As always, they have created buzz in the financial press, with the big news story being the displacement of Coca Cola from its perennial number one spot and the rise of technology companies (Apple and Google have the first two spots and there are four other tech companies in the top ten) in the rankings. Here is the listing of the top ten brand names from 2012 and 2013:

Interbrand, in addition to ranking the brands, also provides estimates of value with Apple’s (AAPL) brand name value estimated at $98.3 billion and Coca Cola’s (CO) at $79.2 billion.

Why brand name valuation matters

If you are an investor or even a corporate manager, you may believe that these brand name rankings matter little, since all they do is parse the value of a company into its component parts. These rankings do, however, raise interesting questions about the power of a brand name and how it manifests itself in earnings power and in value. In fact, there are good reasons why you may want to value brand name independently. From a valuation perspective, separating how much of the value of a company can be attributed to its brand name is important in a variety of contexts:

- Sale of a brand name: If a company is considering selling its brand name alone, while holding on to its physical assets, you have to be able to value the brand name separately from the rest of the business.

- Legal disputes over brand names: Brand names become the subject of legal disputes, with each party claiming the lion’s share of value. Without knowing how to value the brand name and the drivers of that value, you cannot apportion the value to the disputing parties.

- Accounting “fair value”: The shift in accounting towards fair value from original book value has opened the door to accountants also trying to estimate the value of intangibles such as brand names, trademarks and customer lists. While I don’t think this is a good idea and have said so in other forums, it is clearly the trend in international accounting.

From a marketing perspective, where brand name has historically occupied a much more central position, you need to understand what goes into a brand name and how to value it in the following circumstances:

- Advertising spending and evaluation: If one of the key roles of advertising is building up brand name, understanding how much brand name is worth is key to both how much you spend on advertising and how you spend it. It is also a critical component in assessing the effectiveness of advertising in delivering a higher brand name value.

- Pricing and product decisions: The products that you offer and how you price them will depend can be affected by and can have an effect on your brand name value. Thus, if you are an elite brand name apparel company, you may choose not to introduce a lower priced product out of fear that it will hurt your brand name and thus your value.

The power of a brand name

While there are some who bunch together all of the competitive advantages possessed by a company into the “brand name” category, I think we are better served isolating brand name from other competitive advantages. Consequently, I have a narrow definition of the power of a brand name, which I am sure that some of you will take issue with.

Brand name power: The power to charge a higher price than your competitors for an identical or almost identical product or service.

To provide an illustration of pure brand name power, I took a stroll through my local pharmacy and found these two bottles in the painkiller aisle:

The generic aspirin was priced at $2.25 and the Bayer version was priced at $6.00. Aspirin, of course, has been off patent for decades and the ingredients in Bayer Aspirin and its generic counterpart are identical. Clearly, though, there are customers who are willing to pay a premium for the Bayer Aspirin, notwithstanding that reality. In fact, you can find multiple examples of this generic/brand name price disparity through grocery stores and pharmacies.

So, what explains the pricing power of a brand name? It would be far too easy to get on a soap box about consumer irrationality, but I would not dare to do so, because I am sure that we have all been guilty of this irrationality, if not with Aspirin, with other products. Brand name power is a testimonial to how our choices as consumers are driven not just by product characteristics and prices, but also by an array of behavioral factors. It is no wonder then that the secrets to creating a valuable brand name are shrouded in mystery. If it were just spending advertising dollars, the big ad spenders should dominate this list of top brand names but there are many who don’t show up. Conversely, there are companies that seem to come out of nowhere and become valuable brands in short periods: Snapple in the early 1990s, Lululemon and Under Armor in the last few years. Brand name value is as much a function of luck and serendipity as it is a function of planning and design.

The value of a brand name

If you accept my definition of brand name power, the process of valuing it then becomes simple, at least in the abstract. It would require you to answer the following question: If you are a brand name company and you lose your “brand name” overnight (consumers develop selective amnesia), what would happen to the value of the company?

That question is easier posed than answered because facile comparisons don’t quite capture the effect. Thus, comparing the market capitalization of Coca Cola to the market capitalization of a generic brand name company will tell you little about brand name value. While the comparison of pricing multiples (PE, PBV or EV/Sales) between brand name companies and their generic counterparts are more useful, there are still too many unknowns to control for. As I see it, the only way to value brand name is to use an intrinsic valuation model, identify the drivers of value and then look at how brand name and generic companies differ on those drivers, with consequences for value.

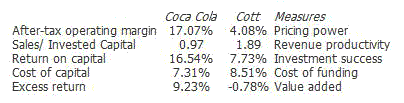

Rather than talk in abstractions, let’s pick a company: Coca Cola. Though it may have dropped out of the top spot on Interbrand’s list this year, it remains an iconic brand name, recognized in almost every corner of the world. To value the brand name of the company, I have to first identify differences on key valuation metrics between Coca Cola and a generic counterpart. In this case, I was able to find a generic manufacturer of beverages, Cott Inc., a Canada-based company that produces beverages that can be branded by grocery stores as their own. To illustrate the enormous advantages that Coca Cola’s brand name endows it with, I compared the two companies in the table below:

Note that Coca Cola’s after-tax operating margin of 17.07% is almost 3.5 times higher than Cott’s after-tax operating margin of 4.08%; the return on capital for Coca Cola is 16.54%, 9.23% higher than its cost of capital of 7.31%, whereas Cott’s return on capital of 7.73% lags its cost of capital of 8.51% by 0.78%.

So, how do we devise a pathway from these numbers to a value for Coca Cola’s brand name? This is after all not meant to be a comparison of Coca Cola with Cott, two companies of vastly different scale. Here are a couple of options:

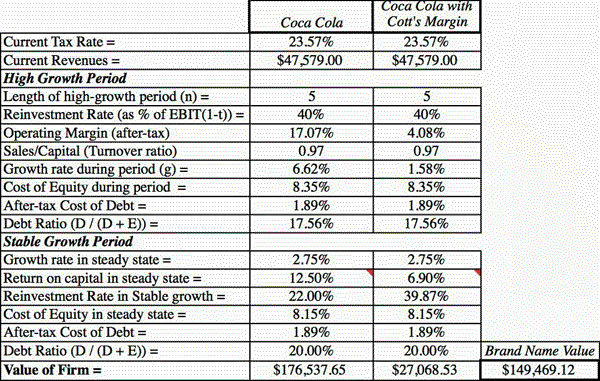

Option 1 (Coke’s margin = Cott’s margin): Assume that Coca Cola loses its brand name overnight and that it’s operating margin converges on Cott’s operating margin of 4.08%. That drop in margin has ripple effects, lowering the return on capital and growth rates. Holding revenues and the cost of capital fixed, that translates into a value for Coca Cola’s brand name of $149.5 billion.

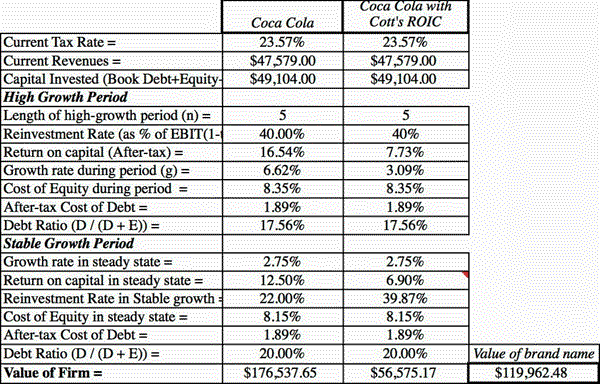

Option 2 (Coke’s ROIC = Cott’s ROIC): One reason that option 1 may over estimate the value of the brand name is because Cott is more efficient in generating revenues per dollar of capital invested ($1.89 per dollar of invested capital) whereas Coca Cola generates only $0.97 per dollar of invested capital. Giving Coca Cola both the margin (4.08%) and the sales to invested capital ratio (1.89) that Cott has effectively gives it Cott’s ROIC (7.73%) and this reduces the value of the brand name to $120 billion.

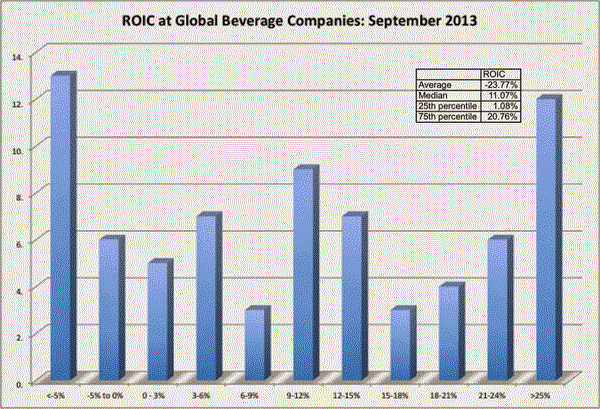

Extending this approach to other brand name companies, you may face one potential hurdle: finding a generic competitor. Even in the case of Coca Cola, you may take issue with the use of Cott Inc. since it margins may not be reflective of the margins of a generic company. One solution is to look at the distribution of key metrics (ROIC, operating margin, sales to capital ratio) across the sector. For instance, looking at the distribution of return on invested capital across global beverage companies:

Note that the distribution is split, with lots of companies at either end of the distribution: high ROIC and low ROIC. You can then use the median ROIC (or some lower percentile if you prefer) of the sample of 11.07% as your generic ROIC and use it in your valuation). There are other choices that you can make: that all of the excess returns are due to brand name, that Coca Cola earns the same excess returns as Cott etc. The value for the brand name ranges from $90 billion to $150 billion, depending on your choices and you can see them all in this spreadsheet.

Note that this approach works well for Coca Cola, since there is little else other than brand name that separates one sugared, colored beverage from another. It is much more difficult to do this analysis for Apple, where you can argue that pricing differences are only partially driven by brand name and can also be explained by differences in operating systems, features and quality. Thus, while we can estimate the portion of Apple’s value that can be attributed to all of these competitive advantages collectively, parsing it among the advantages can be in the eyes of the beholder.

Implications

- Brand name is one of the most sustainable competitive advantages in business: There are very few competitive advantages that have survived as long as brand name. A technological edge can be lost and economies of scale can be matched but brand names often endure the slings and arrows of competitive fortune.

- Brand name is not the only competitive advantage: Not all valuable companies have a valuable brand name (Eg. Walmart, Exxon Mobil) but they have other competitive advantages; Walmart’s edge comes from unmatched economies of scales and supply chain management whereas Exxon’s come from its reserves).Even some of the companies on the Interbrand list have questionable brand name values. As I see it (and I am biased), Microsoft’s competitive advantage has not been its brand name. With both Windows and Office, the company has used a mix of overwhelming force (packing the products with features that most of us never use) and a networking effect (where not using them makes you the odd person out) to win.

- Misidentifying your competitive advantage can be dangerous: You may feel that the parsing of competitive advantages that I am doing is pointless, since they all lead to excess returns, but I do think that it matters. If you do not know what your true competitive advantage is, it will not only be difficult to nurture it but you may put it at risk with your actions. Thus, while brand name value is a sustainable advantage, its benefits can still be lost by careless, deluded or distracted managers. A classic example is Coca Cola’s ill-fated attempt in 1986 to introduce New Coke, in a misguided belief that it was taste that mattered, when in fact it had little to do with Coca Cola’s success.

- Investor alert: If you are an investor in a company whose primary competitive advantage is brand name, the primary risk you face to your wealth is not that the company’s growth will lag (though that is always a concern) but that its pricing power will dissipate. In pragmatic terms, investors in brand name companies should track operating margins at these companies, staying alert to slippage.

Brand name spreadsheet: Generic spreadsheet for valuing brand name

My paper on valuing brand name and other intangible assets

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply