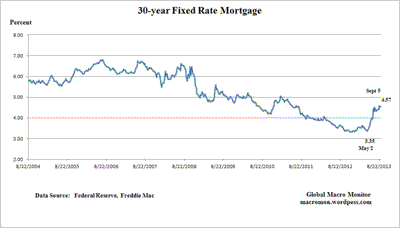

As the 10-year Treasury yield approaches 3 percent let’s take a look at the recent spike in mortgage rates and its micro impact on the housing market and average home buyer.

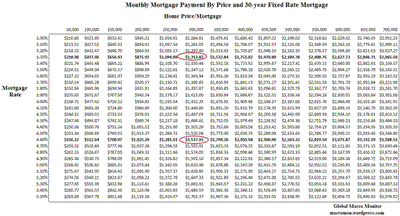

The chart below shows 30-year fixed mortgage rates have increased 122 basis points since early May. This translates into a 17 percent increase in the monthly payment on a $300K mortgage, for example from $1,313 to $1,538 per month (see Matrix).

Though recent home sales have had a high proportion of cash buyers the monthly mortgage nut does still matter for most buyers and remains one, if not, the biggest constraint on new purchases and housing price appreciation. For example, the $1,313 monthly payment, which supported a $300K mortgage at 3.30 percent in early May, for example, now only qualifies for a $255K mortgage.

If homes traded like bonds, which are the sum of discounted coupon and principal payments, the spike in interest rates since early May would have resulted in a 15 percent fall home prices. This surely is one of the reasons why the homebuilder stocks have been hit hard over the past few months.

In the past, innovation and financially engineered mortgage products such as option ARMS have limited the impact rising rates have had the housing market. Those daze, we think, are over. Maybe.

(click to enlarge)

(click to enlarge)

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply