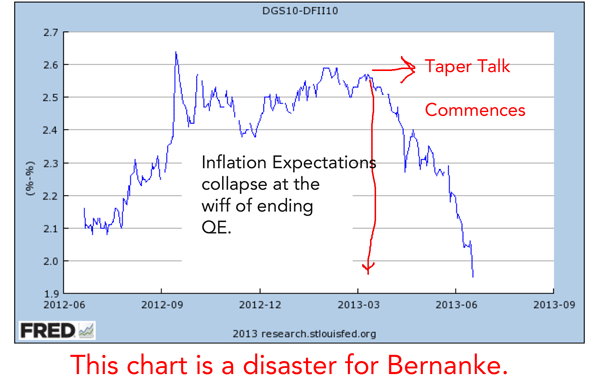

The TIPS market has told an interesting story the past month. The implied inflation rate has collapsed. As of this morning, the market is pricing inflation at 1.94%%. A few month ago it was 2.5%.

The market is saying that when QE is in full force, with no end in sight, inflation expectations are high. When there is even a scent of QE being cut back, inflation expectations fall. The markets are therefore acting ‘rationally’.

That the market is repricing inflation lower must be killing Bernanke. It’s the worst possible outcome for him. In a Zero Bound world the only thing that Ben can do is juice up inflation expectations. It’s remarkable that Bernanke can whisper about ending QE (with absolutely no clarity on the timing and pace) and he kills the chance that the economy will actually improve.

This is a complete failure of Bernanke’s communication policy. It’s so significant that I think there has to be another development. Ben is going to try (again) to calm down market jitters. So far, his usual tricks to goose markets have not worked. Hilsenrath has tried and tried to send Bernanke’s message that the Fed is not easing up on the short end to no avail. If Bernanke says something on the record, it will likely be met with more selling. So what could Ben hint at that that might get the Bears retreating? How about:

FLASH: Fed to Cap long-term interest rates.

FLASH: Fed will increase QE if rates rise to 2.75% in 10 year note.

FLASH: Fed prepared to conduct unlimited purchases to maintain Cap.

FLASH: Cap to be maintained as long as Fed Governors deem necessary.

FLASH: Fed sees Cap as short-term measure. Cap will be eliminated when markets stabilize.

Seat belts on….

Note:

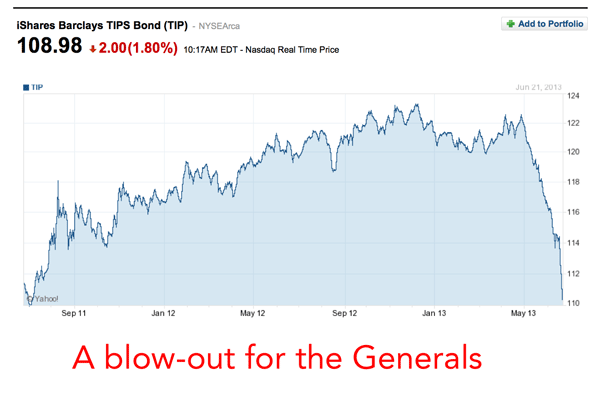

All fixed income investor have had their faces ripped off of late. I have not one tear of sympathy. Of interest to me is that the worst hit investors are those who made a bet on long-term TIPS.

Two years of gains were wiped out in a month. The Ten-year TIP has tacked on 104bp in yield in a month, the Ten-year coupon bond added only 59bp. The red ink on TIPs is flowing freely at this point. A question to ask is:

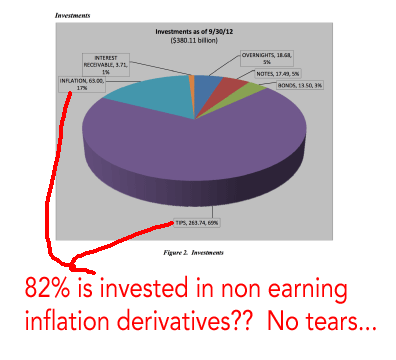

What bond fund is loaded to the gills with TIPS?

The surprising answer to this question is that it’s the US Military that is getting thumped. Follows is a pic of the Military Retirement Fund holdings. To me, the Generals bet the farm with this investment approach.

Fortunately, the “Brass” fight battles much better than they invest money.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply