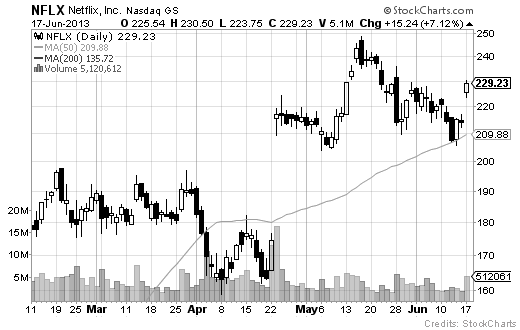

Shares of Netflix (NFLX) rallied over 15 points on Monday after the company announced a new multi-year programming deal with DreamWorks Animation Skg Inc (DWA), which will allow the online video-streaming and DVD-rental company to offer over 300 hours of first-run programming produced by the cartoon studio. Netflix’s stock got an immediate boost on the news, gapping up to $225 and trading as high as $230.50. The ticker came off of its intraday high to close at $229.23, up 7.12% on nearly 100 million shares. The stock of the streaming content provider is up 228% year-to-date/52-wk: $52.81 – $248.85.

As NFLX continues to make HH from the current range, and as this upper range continues to be in play, momentum traders could take the name to re-test or possibly take out its next major overhead resistance located at the $240 level.

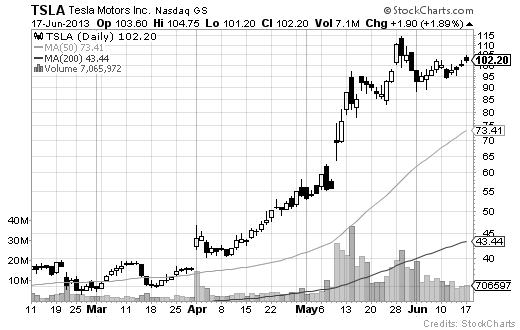

Tesla Motors (TSLA) ripped higher again on Monday after Global Equities Research analyst Trip Chowdhry initiated coverage of the stock with an ‘Overweight’ rating and a 12-18 month price target of $150. The upgrade pushed shares of TSLA within range of triggering another near-term long trade. Momentum traders should now look for a long-biased trade in TSLA as long as it’s trading above overhead resistance located at the $103.20 level. Once the ticker sustains a move above those levels, then TSLA will set up to re-test its next resistance levels at $113.55.

Tesla Motors closed up 1.89% to $102.20 on Monday. The stock has rallied 193 percent year-to-date, pushing its PPS to about 73x Wall Street’s forecasts for its 2014 profit.

Disclosure: No Position

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply