There is a great natural economic experiment unfolding. And it is not the QE3 versus U.S. fiscal austerity debate that some of us have been debating. Rather it is the United States versus the Eurozone and the different policy “treatments” their economies are receiving. Jim Pethokoukis explains:

[W]e have an intriguing natural economic experiment. Two large, advanced economies are both undergoing fiscal austerity from spending cuts and tax increases. But one is recovering, though glacially, from a previous downturn; the other is deteriorating.The likely difference: monetary policy. Not only did the Federal Reserve slash short-term interest rates to nearly zero way back in 2008, but it has also embarked upon a massive bond-buying program known as quantitative easing. The European Central Bank, however, only last month cut its key interest rate to 0.5 percent, still higher than the Fed-funds rate. And the ECB’s “unconventional” monetary policy has been far more modest, with bond purchases less than a tenth the size of the Fed’s. Its goals have also been more limited: stabilizing southern Europe’s debt markets and avoiding a financial crisis. At a recent speech in Frankfurt, Germany, St. Louis Fed president James Bullard said that unless Europe adopts an aggressive bond-buying program, it risks an extended period of low growth and deflation like what Japan has experienced since the 1980s.

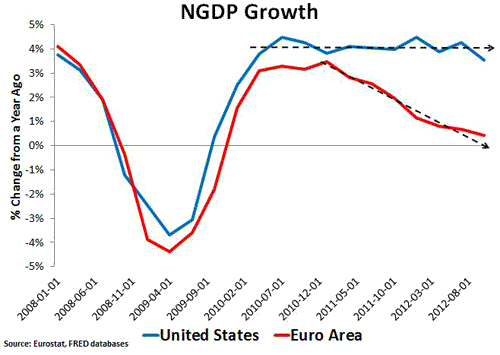

This policy treatment explains the different NGDP trajectories in this figure:

What is puzzling to me is how anyone could look at the outcome of this experiment and claim the Fed’s large scale asset programs (LSAPs) are not helpful. Some claim the LSAPs are just helping the rich, at best, and may even be deflationary. But it is not hard to imagine how much higher U.S. unemployment would be were it not for the Fed’s QE programs. Just look to Europe’s unemployment rate, as noted by Pethokoukis. Yes, the LSAP programs are far from ideal but they are keeping Americans from experiencing the unemployment seen in Europe. In other words, QE is helping the lives of ordinary working people in the Unites States. And there are many ordinary working Europeans whose lives would be much better off if the ECB were to more closely follow the Fed’s actions.

The insights from this natural experiment should give QE critics pause. And so should the fact that these these programs are helping shore up the supply of safe assets. Critics who see the slow recovery and point to the Fed’s LSAPs simply are not doing the right (if any) counterfactual.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply